Opportunities in 2023, Caution Lights in 2024

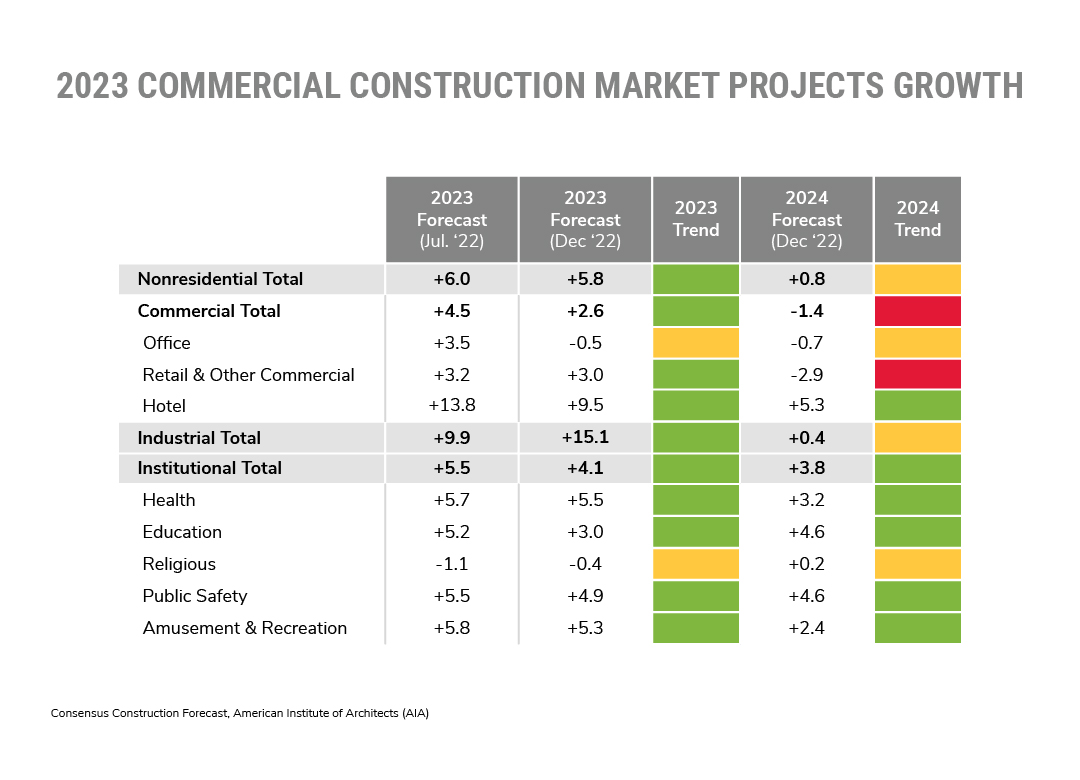

Despite ongoing economic volatility, 2023 is looking strong for the commercial construction market. The AIA’s semi-annual Consensus Construction Forecast is projecting growth for just about every non-residential segment of the construction market. While not as strong as originally projected in July, the 2023 forecast suggests there are many opportunities. The bigger challenge may be in sustaining this momentum into 2024.

Commercial Segments Look Solid in 2023

Here’s a look at each segment, ranked by their expected growth in 2023.

PRO: The industrial segment offers the strongest growth potential in 2023. There is a warehousing shortage due to bloated inventories, changing supply chain protocols and a lack of new facilities, all effects of the pandemic. CNBC reports the U.S. may need 1 billion square feet of industrial space by 2025. Other industrial segments will also expect to drive construction as government incentives in power/utilities, green energy, microchips, and infrastructure drive new manufacturing projects.

CON: High interest rates may deter some investment. Labor availability is an ongoing problem.

BOTTOM LINE: All signs point to growth in 2023 for the industrial segment.

EARLY '24 VIEW: +0.4% After a strong 2023, incremental growth looks to level off, especially as inflation impacts consumer spending and the need to warehouse higher inventories of goods. But, continued investment in domestic production capability may balance things out.

PRO: The pandemic’s impact on the hospitality segment was significant and forced the industry into a lot of change. Investment in new facilities was delayed until the industry could be more certain as what the future business opportunity – along with staff to support it – would look like. Increased consumer travel, the return of greater business travel, and increased hiring in the sector all point to an active year in new development.

CON: Post-pandemic, business travelers have re-calibrated their own travel investments. It is more acceptable to use video conferencing for meetings, and CFOs are now counting on lower travel and entertainment expenses. Additionally, instability with the airlines may limit travel frequency for both business and leisure travelers. Take a look at the Top 20 Cities for Hospitality Investing in 2023.

BOTTOM LINE: There is a yearning for business traveler to develop face-to-face relationships once again, especially because it becomes more important to keep customers loyal when the economy faces a potential downturn. On the leisure travel side, consumers are just getting back to the normalcy of their vacation habits.

EARLY '24 VIEW: +5.3% Continued investment in the hospitality construction segment is expected through 2024 as key stakeholders anticipate future business growth.

PRO: As the U.S. population continues to age, so will the need for more and better healthcare services. At the same time, healthcare needs are broadening – from critical care to elective treatments to addressing mental health. The real opportunity, according to Healthcare Facilities Today, is with outpatient facilities, where volume is expected to grow almost 21% over the next ten years. Outpatient facilities offer a less expensive real estate investment sine many are in suburban and rural areas. Moreover, the outpatient model is more attractive to insurers and more convenient for patients.

CON: While healthcare networks are adjusting more toward the outpatient model, increasing hospital costs and declining margins may present an obstacle to further facility investment. Add in rising construction costs to build facilities, and it will muffle further growth.

BOTTOM LINE: Changing demographics continue to increase healthcare demand and the need for new facilities to service patients.

EARLY '24 VIEW: +3.2% Healthcare construction investment is one of the steadiest segments year after year.

PRO: Coming out of the pandemic, consumers are regaining their desire for in-person entertainment and events, and low unemployment rates suggest consumers can and want to spend on entertainment. Even as the economy worsens, consumers often maintain entertainment budgets since they provide an escape from daily realities. FMI Corp, one of the contributors to the AIA Consensus Forecast, is even more bullish on the segment, seeing an 8% increase for 2023.

CON: The construction of new casinos has been a recent growth source, but as FMI Corp projects, demand for physical facilities may stall as online gambling continues to grow and offer consumers a rich, immediately gratifying experience. Interest in attending sporting events is waning with younger demographics who traditionally were a dependable fanbase. Consumers who remain sporting fans are finding other ways to consume their sporting experience without the hassle and expense of attending the actual game.

BOTTOM LINE: Entertainment will always own a considerable share of the consumer wallet. The key is to closely follow demographic trends toward the types of entertainment venues that can consumers are willing to visit in person, like concerts, amusement parks, and more interactive offerings.

EARLY '24 VIEW: +2.4% Amusement and entertainment construction remains positive into 2024, with an eye on identifying the right opportunities.

PRO: May 2023 report shows monthly public safety construction spending of $11.2B in March of 2023, up 2.9% from a year ago. A broader view of public construction spending sees year-over-year increases in other segments like water supply (+25.5%), power (+16.8%), highway and street (+21.4%), and sewage and waste disposal (+24.2%).

CON: While government dollars have been allocated toward infrastructure improvements, delays due to securing contracts, finding skilled labor, and working through regulatory considerations have the propensity to slow the momentum.

BOTTOM LINE: FMI Corp sees a 7% growth rate in 2023, driven by allocations in the federal omnibus bill, including investments in border safety.

EARLY '24 VIEW: +4.6% This segment is expected to carry momentum into 2024 as allocated funds move from planned to active.

PRO: According to the U.S. Census, construction March 2023 spending for education was $108.2B, +10.7% higher than a year ago. The big story in those numbers is that the largest year-over-year increase was in spending for private school education (+17.9%).

CON: Colleges and universities continue to struggle with declining enrollments as costs rise. The uncertainty of student loan debt is also a factor.

BOTTOM LINE: Education construction is a consistent segment performer. FMI projects a stronger 2024 (+6%) than in 2023.

EARLY '24 VIEW: +4.6% The next two years are expected to demonstrate opportunities for construction growth in the education market.

PRO: Look for opportunities using mixed space, smaller retail footprints, and an emphasis on creating richer customer experiences in-store. This might mean more of an emphasis on renovation vs. new construction.

CON: Inflation and overall economic worries continue to dampen consumer confidence, thus limiting how much retail commercial construction moves forward in 2023.

BOTTOM LINE: Opportunities will be best evident in some markets more than others, but +3.0% growth is encouraging given the economic headwinds.

EARLY '24 VIEW: -2.9% FMI forecasts a tougher time for retail construction next year (-11% growth), primarily because the nation could be in the midst of a recession at the time.

PRO: There is a longing for a sense of community coming out of the pandemic, and there has been a return to the churches.

CON: Cultural and generational changes continue to result in more of the population moving away from organized religion, thus tempering any need for future construction to meet demand.

BOTTOM LINE: Limited opportunities

EARLY '24 VIEW: +0.2% Basically, flat from prior declining years.

PRO: More companies are returning to the office or are moving from 2 to 3 days per week in office. Companies are rediscovering the need for greater collaboration and relationship building relationships, which are often better cultivated face-to-face interaction. FMI Corp suggests that data centers are an area of opportunity for new construction growth as are companies who are moving offices to new cities or out of urban environments.

CON: FMI Corp, like the AIA Consensus Forecast, sees a flat performance in 2023. Subleasing activity is robust as many companies continue to seek ways of reducing their physical footprint. Hybrid work arrangements are here to stay in many industries.

BOTTOM LINE: Limited opportunities, but still projected by FMI Corp to be an $87B segment in 2023.

EARLY '24 VIEW: -0.7% Expect a continued decline in the need for new offices for the next few years.

The “R” Word: The Latest Thinking

The question on everyone’s minds: Will the nation slip into a recession in the near future? There is no consensus, and the thinking seems to shift almost every week.

Consider a recent survey conducted by the National Association of Business Economists, which found that 54 percent of those surveyed put the odds of a downturn in the next year at 50 percent or less.

The market must sort out mixed signals. Employment continues to grow but at a slower pace. Inflation is easing, but it remains a factor, particularly when it comes to borrowing.

While the AIA Consensus Construction Forecast shows opportunities for growth, conflicting macro-economic trends coupled with the upcoming presidential election cycle will undoubtedly have an impact on the momentum for each segment of the construction industry.

Let’s talk.

Have a specific marketing challenge? Looking for a new agency?

We’d love to hear from you.