It’s 2024 That You Need to Keep an Eye On

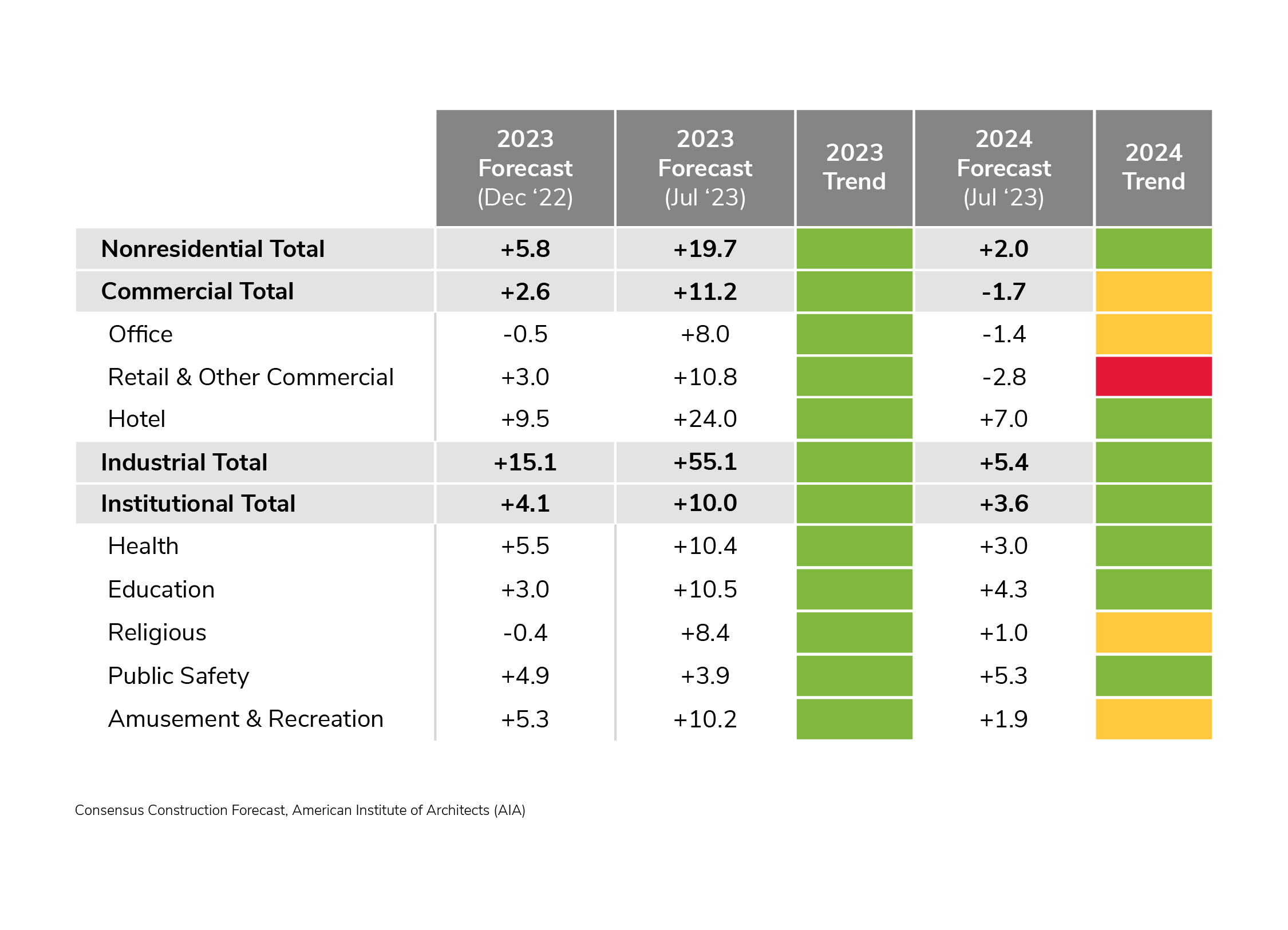

Despite ongoing economic volatility, 2023 is looking strong for the commercial construction market. The AIA’s semi-annual Consensus Construction Forecast is projecting growth for just about every non-residential segment of the construction market. While not as strong as originally anticipated in July, the 2023 forecast suggests there are still many opportunities. The bigger challenge, however, may be in sustaining this momentum into 2024.

Second Half of 2023 Looks Strong Before Tailing off in 2024

Here’s a look at each segment, ranked by their expected growth in the second half of 2023 and into 2024.

PRO: The AIA Consensus Construction Forecast significantly upgraded the manufacturing segment for the second half of 2023 by 40 percentage points. The pandemic uncovered global supply chain dependency risks, and combined with geo-political issues and government incentives, the motivation to build domestically is very strong. FMI Corp, a AIA Consensus Forecast contributor, sees new energy, electric vehicles, semiconductors, batteries, and biopharmaceuticals as segments driving the activity.

CON: High interest rates are a barrier to entry and banks are tightening lending requirements. But ultimately, it is the ongoing skilled labor shortage and the high cost of labor that could blunt the momentum.

BOTTOM LINE: With recession fears alleviated – at least for now – expect this segment to boom. Look for heavier investment in factory automation as an answer to the labor issues.

EARLY '24 VIEW: +5.4% The projections are solid going into 2024, but almost 45 percentage points lower than 2023. FMI Corp is slightly more bullish forecasting 8% growth in 2024. Consumer consumption declines and recession fears are influencing next year’s outlook, but based on 2023 momentum, the 2024 forecast appears conservative.

PRO: A 2023 survey on travel trends by Forbes suggests 49% of consumers plan to travel more in 2023. In addition, business travel continues to grow as more live events have returned and sales teams are sensitive to maintaining strong face-to-face relationships as supply chains and economics remain temperamental.

FMI Corp projects a $22 billion market for this segment in 2023, and another $23 billion in 2024, with development in public/private investment in transportation, infrastructure, entertainment venues, and downtown revitalization fueling the need for new hotel space.

CON: Inflation has impacted the cost of construction including materials, labor, and land. According to CBRE, most markets have increased by 10-20%, cutting into the developer’s profit margin and leading to delayed starts. Additionally, financing costs have risen with higher interest rates. On top of pure finances, the airline industry is not making travel easy for their customers.

BOTTOM LINE: Construction costs may have peaked. Consumers are travelling again, and business travel, while not back to pre-pandemic levels, is a consistent driver.

EARLY '24 VIEW: +7.0% Continued investment in the hospitality construction segment is expected through 2024 as this is a long putt toward future business growth.

PRO: As demographics continue to shift geographies, growth is expected in mixed-use space and smaller retail environments, especially in developing suburban and exurb markets. Renovating existing office space into retail and mixed-use is an opportunity for city spaces. FMI Corp notes that, facing ongoing inflationary concerns, consumers will look to increase value-oriented discount and big-box retail shopping.

CON: Consumer spending continues to face inflationary headwinds. Retail eCommerce continues to grow, causing a shift in large retail spaces taking on smaller footprints. A continued lack of workers dampens confidence to build more stores such as restaurants.

BOTTOM LINE: The current momentum is strong with double-digit growth projected for 2023. FMI notes as much as 50% of the commercial segment is being driven by warehousing and distribution center needs.

EARLY '24 VIEW: -2.8% As populations continue to shift, the need for mixed space and retail will remain an opportunity. However, sustainable year-over-year growth is dependent on consumer’s confidence to keep spending money. The financial health of a consumer has far-reaching impact, from the store level where the product is sold to the warehouse where inventories are managed based on demand.

PRO: According to the U.S. Census, total construction spending in June 2023 is up at a seasonally adjusted rate of 7.9% from a year ago. Within that segment, private education construction is up 17.9% and public is up 5.6%.

Trends in new school construction center around safety concerns as well as establishing Career and Technical Education (CTE) programs for students to have exposure and training with skilled trades, engineering, advanced manufacturing and computer science, according to Building Design + Construction.

CON: According to a 2023 study by National Student Clearing House Research Center, enrollment in colleges and universities is 1.2 million students less than pre-pandemic levels. The declines are particularly affecting 4-year non-profit institutions. However, there are gains in both 2-year community colleges and for-profit schools.

BOTTOM LINE: Despite the enrollment challenges in the college and university market, education construction remains a consistent high performer in the segment. It is a $100B market that consistently realizes steady growth.

EARLY '24 VIEW: +4.3% FMI projects a stronger 2024 (+6%) than in 2023, and 2-3% growth annually through 2027.

PRO: An aging U.S. population and a shift to convenient, suburban outpatient centers continues to drive construction activity in the healthcare segment. A recent study done by Health Facilities Management breaking down specific areas of hospital projects planned for the next three years, the general split shows 33% for acute care facilities, 20% for specialty care, and 16% critical access. Within the specialty care, the largest planned facilities are behavioral health centers (36%), cancer treatment hospitals (26%), and children’s hospitals (26%).

CON: Increased construction and land costs combined with declining margins within hospital networks can dampen prospects.

BOTTOM LINE: The healthcare construction segment is very consistent year-to-year. FMI Corp is forecasting it as a $57 billion industry in 2023, and between $59 billion and $62 billion for the next four years.

EARLY '24 VIEW: +3.0% Continued growth is expected in 2024. FMI Corp’s forecast projects 5% growth in 2024.

PRO: Consumers seek entertainment as an escape from the day-to-day monotony of life and often use entertainment events such as sports, concerts, and amusement parks as social activities with family and friends. Even when economic times aren’t good, entertainment spending stays rather consistent. Work-life balance is as robust as ever, with workers spending more time at home on hybrid work arrangements, allowing for more time and a stronger desire to get out and enjoy entertainment experiences.

With construction activity for infrastructure and transportation increasing due to recently approved federal investment, look for this category to pick up in those markets where infrastructure improvement is strongest.

CON: More stringent lending policies and increasing interest rates impact investment in large venue projects such as stadiums. Consumer discretionary spending may lessen as inflation is still increasing year-over-year with a waning economy.

BOTTOM LINE: According to the U.S. Bureau Monthly Construction Spending report, total construction spending for amusement and recreation is up 1.1% in June 2023 versus May; and up 5.7% from June 2022 at a seasonally adjusted annual rate. While there is opportunity for growth, rising interest rates and stricter lending policies may limit investment growth.

EARLY '24 VIEW: +1.9% Amusement and entertainment construction forecasts are less attractive in 2024. FMI Corp. anticipates a 3% growth for 2024, but a 7% decline in 2025.

PRO: The U.S. Census Bureau Monthly Construction Spending, June 2023 report shows the seasonally adjusted annual rate for religious construction up 3.7% from the previous month in May 2023, and up 1.3% year-over-year. The AIA’s forecast of 8.4% is the strongest outlook given to this category in a long time. The trend is likely due to renovation activity to repurpose the structures. However, as demographics shift to new markets, there will be a need for new worship facilities.

CON: This is a small segment of the market with many headwinds. A decline in overall attendance and membership combined with more online consumption of services dims the overall outlook.

BOTTOM LINE: Limited potential longer-term, but opportunities can be found in pockets.

EARLY '24 VIEW: +1.0% Remains flat and/or declining over the next few years.

PRO: There is momentum for increased time in the office with many organizations requiring 3 days in the office and 2 at home. Amid high vacancy rates in central downtowns, older buildings need to compete with newer ones for a much smaller share of tenants spurring increased building renovation activity. Companies have the leverage to seek Class A office space with smaller footprints. Data centers are a subsegment continuing to drive demand.

CON: Coming out of the pandemic, there will be many defaults in loans over the next few years, as many buildings are no longer worth what they once were. Reduced availability of credit puts a crimp on funding for new projects. Major downtown skyscrapers sit vacant, losing their value and risking devaluation.

BOTTOM LINE: Despite the short-term positive segment outlook, central downtown areas will need to re-imagine themselves, as the pre-pandemic workforce populations are not coming back. Look for a combination of retail, residential housing, and entertainment-based growth to fill the gap and drive lifestyle-oriented populations where there were once corporate cubicles.

EARLY '24 VIEW: -1.4% Increasingly vacant office space is a national problem and community leaders and developers alike need to be creative with the solutions. Ideas to convert office space into residential use is admirable, but not practical as a long-term fix. FMI Corp is more bearish on this segment projecting a 5% decrease in 2024 and another 7% decline in 2025.

PRO: The U.S. Census Bureau Monthly Construction Spending, June 2023 report shows monthly public safety construction spending of $12.7B at a seasonally adjusted annual rate – up 7.5% from a year ago. A broader view of public construction spending sees year-over-year increases in other segments like water supply (+6.4%), power (+4.9%), highway and street (+20.3%), and sewage and waste disposal construction (+24.2%).

CON: The skilled labor shortage along with the current regulatory environment continue to present the largest barriers for this segment.

BOTTOM LINE: FMI Corp sees a 3% growth rate in 2023, on par with the AIA Consensus Forecast.

EARLY '24 VIEW: +5.3% FMI is projecting an 8% increase in 2024, followed by another 7% increase in 2025 as the Fed-approved dollars are implemented.

Short-term Momentum, but Can It Be Sustained?

While there are concerns with the economy and shifts in trends for how non-residential space is used, the short-term indicators suggest a strong market that may cool off in 2024 in particular segments. However, for a building and construction company looking to focus their market strategy, the key is to find the opportunities that best match the strengths of the brand.

Let’s talk.

Have a specific marketing challenge? Looking for a new agency?

We’d love to hear from you.