Optimism Remains for Certain Sectors Despite Recession Fears

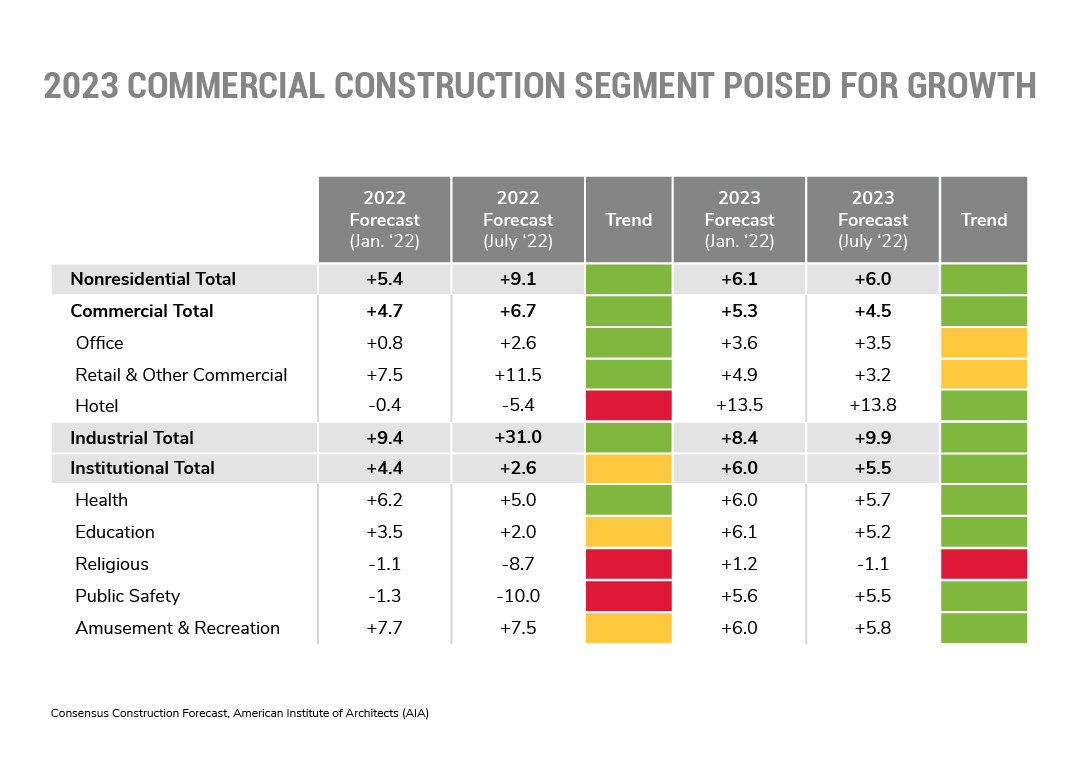

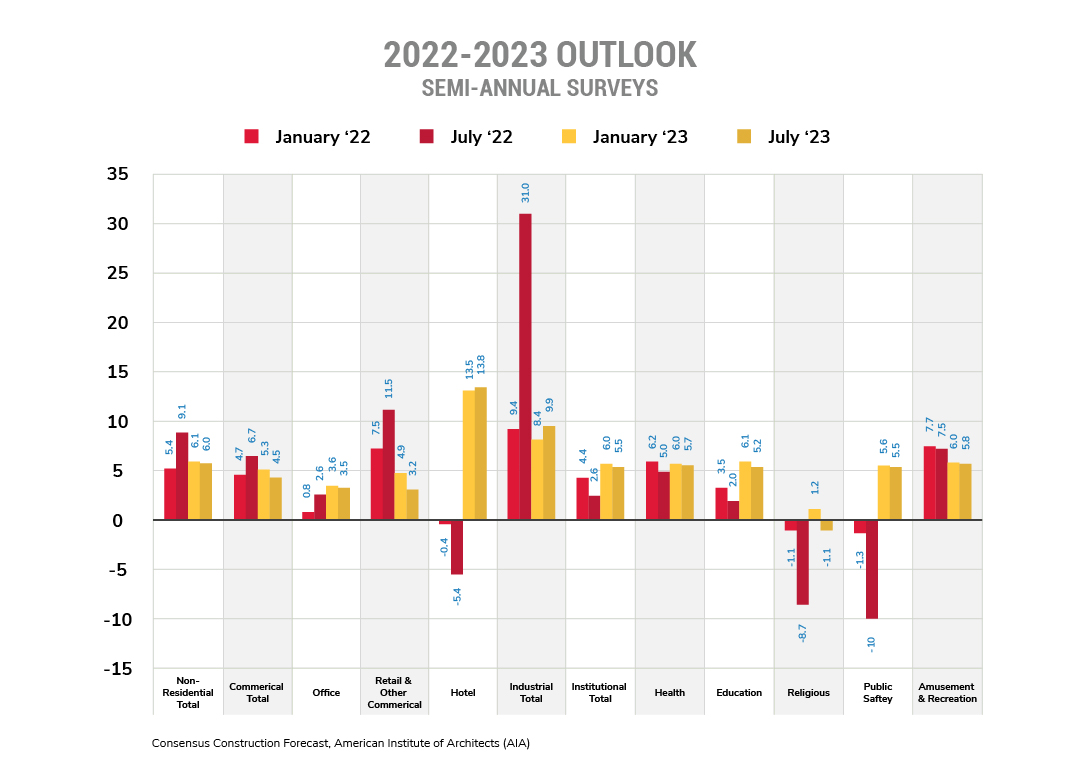

Despite the recession talk, 2023 is looking strong for the commercial construction market. The AIA’s semi-annual consensus construction forecast is projecting growth for just about every nonresidential segment of the construction market. The forecast also upgraded many building segments in 2022. Overall, the nonresidential activity is expected to finish 2022 strong (+9.1%) and maintain momentum in 2023 (+6.0%).

Many Commercial Segments Look Solid in 2023

Here’s a look at each segment, ranked by their expected growth in 2023.

PRO: The travel and resort industry has experienced a longer pandemic impact than most other building segments. Beyond the reluctance for consumers to travel regularly coming out of the pandemic, staffing and employment has been a lingering issue, creating financial uncertainties and delaying new investment. 2023 appears to be the year this will change.

CON: Staff recruitment and retention remains a problem, and consumers are growing increasingly less confident in the airline industry’s ability to deliver on their promises. This creates new reluctance for travelers to commit to trips.

BOTTOM LINE: While the frequency of business travel likely will change in the long term thanks to the efficiencies provided by video conferencing, businesses feel the need to connect with customers beyond the transactional relationship. In-person tradeshows in 2023 are expected to rebound as we get further away from the pandemic restrictions. Consumer demand for vacations was strong in 2022. All of this looks positive for the hotels and resorts segment so long as the airlines can maintain consistency.

PRO: The industrial segment is poised for strong growth. The revised 2022 forecast projects a 31% boost that will fuel continued momentum in 2023. Supply chain issues from the pandemic have put a new focus on domestic manufacturing. Warehousing needs remain strong to fill supply chain distribution gaps, especially as in-home delivery demands rise. Recent government spending in infrastructure and renewable energy products fuels the need further.

CON: Like in other industries, an available workforce is a potential impediment toward manufacturer construction investment. The market remains highly competitive for manufacturing talent.

BOTTOM LINE: This segment carries strong tailwinds as government support, trends, and market factors all influence a growth position through at least 2023

PRO: According to Census.gov, 2022 Q2 revenues in the amusement, gambling, and recreation industries were over $41 billion, which is up 146% from the height of the pandemic shutdowns in the second quarter of 2020 and the height of the pandemic shutdowns when revenue bottomed out at just under $17 billion. Total revenue for this category has been consistently rising ever since, and this does not include sporting event activity in its revenue projection.

CON: Longer-term consumer spending on non-essentials can be fickle as inflation continues to rise and a potential recession is top of mind.

BOTTOM LINE: Despite inflationary and recessionary concerns heading onto 2023, the steady increase in amusement, gambling, and recreation revenues indicates a lower-risk opportunity for infrastructure investment. Even as times get tough, consumers typically maintain spending in entertainment to forget about everyday challenges.

PRO: A number of factors will keep healthcare construction projects active. The population is aging, particularly with the large baby boomer segment. Behavioral health is getting more attention, driving the need for additional facilities. In addition, healthcare systems continue to expand their physical footprints and market share by investing in community-based mini hospitals and additional patient touchpoints. Lastly, approved federal spending includes investment in various health initiatives.

CON: Healthcare is experiencing a skilled labor shortage with nurses, aids, and even doctors. Additionally, construction labor shortages limit how much commercial workforce is available at a given time in a community, especially when other nonresidential segments are poised to grow in 2023. If a new industrial construction project gets a head start in a community, this could delay the new hospital construction.

BOTTOM LINE: Healthcare should be a consistent, steady growth opportunity for the construction market for the foreseeable future.

PRO: The 2022 construction forecast for public safety was adjusted down to -10.0% recently in July. However, with new federal investments hitting local governmental budgets, we should see stronger activity in 2023. The U.S. Census Bureau Monthly Construction Spending July 2022 report shows an average monthly public safety construction spending of $11.3 billion for July, up from $10.7 billion in April.

CON: June 2022 monthly spending in public safety construction is down 6.5% from June 2021.

BOTTOM LINE: According to the FMI Q3 2022 North American Engineering and Construction Outlook, the growth forecast beyond 2023 is between 5 and 8% annually through 2026. One of the factors contributing to this outlook includes the need to address rising crime with increased incarceration rates and new facility needs.

PRO: Growth in the education segment will come from sub-segments within the category. Construction in the private school sector should grow since they picked up enrollment while maintaining in-person learning during the pandemic and have benefitted from and other social issues impacting parents’ confidence in the public school curriculum. According to the U.S. Census, private construction spending for education was 16.2% higher in July 2022 than a year ago.

CON: reports that overall education construction is down 1.3% in June 2022 vs. a year ago, and down -4.8% over the same time period for public school construction. And enrollments for higher education have yet to recover, making it more difficult to fund new capital projects. On top of that, inflation is raising already high tuition rates at colleges and universities.

BOTTOM LINE: Projected growth of 5.2% is very solid. The FMI Outlook is less rosy, projecting 3% growth over the next three years. Loan forgiveness and inflation will continue to impact the growth trajectory.

PRO: The forecast shows some recovery to this segment coming from specific areas. The FMI Outlook calls out data centers (a subset of office) as an area where growth will continue. Overall, the renovation market should remain strong from smaller companies subleasing space from larger company space, and other firms moving into smaller footprints to better accommodate hybrid work-from-home models. This may mean more people in smaller office spaces for a shorter period of time each week.

CON: WFH – even in hybrid forms – is becoming the norm. Business owners don’t value large spaces anymore, especially in downtown business districts. A lot of vacancy is being re-developed into apartments space.

BOTTOM LINE: While new construction in top downtown markets will continue to face headwinds, shifts in population – both to less expensive metro markets and suburban office – locations offer opportunity. Renovations will remain constant, even during potentially recession-driven lean years for the office segment.

PRO: Healthy retailers are using the in-store space as a means for enhancing overall customer experience, especially related to online ordering and pickup and drive-through capabilities.

CON: Inflationary concerns lead to consumers rejecting higher retailer pricing and slowing buying activity. As the FMI Outlook suggests, higher interest rates make it hard for some retailers to invest in expansion and improvements.

BOTTOM LINE: Following the markets where residential housing and population shift is growing is where new retail opportunities will emerge. Uncovering these market-by-market opportunities will blunt larger challenges to this segment.

PRO: Pandemic restrictions are lifted, easing significant pressures the religious community experienced in maintaining active membership.

CON: Trends see declines in overall religious participation, and the pandemic magnified this problem with membership losses that did not return.

BOTTOM LINE: Opportunities for construction growth over the next couple of years will be limited.

Let’s talk.

Have a specific marketing challenge? Looking for a new agency?

We’d love to hear from you.