Learn Where There Are Opportunities for Growth

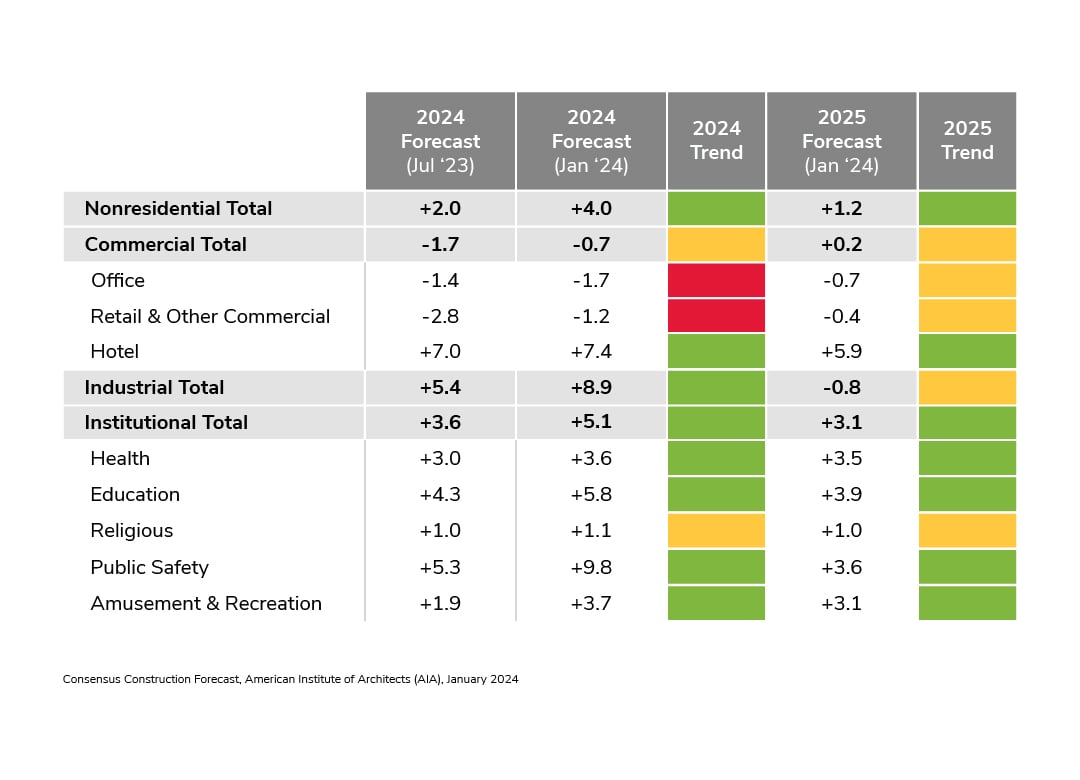

What can we expect in terms of growth and performance in commercial building and construction industry in 2024 and 2025? One of the best known sources of data on the subject is the American Institute of Architects, which publish a consensus construction forecast twice a year. Learn more about their outlook on the industry along with insights from some of the other leading construction industry prognosticators, some of which are part of the AIA’s aggregate data.

PRO: The U.S. Census Bureau Monthly Construction Spending December 2023 report shows monthly public safety construction spending of $14.7B at a seasonally adjusted annual rate, which is up 34.9% from a year ago. A broader view of public construction spending sees year-over-year increases in other segments such as power (+64.8%), sewage and waste disposal construction (+23.0%), water supply (+19.8%,) highway and street (+25.9%), and transportation (+9.3%). FMI Corp projects continued growth of 13% in 2024, estimating the U.S. safety construction segment to be worth $16 billion.

CON: While the funding and intent is there, the barrier is the ability to support spending with necessary labor required for such large projects.

BOTTOM LINE: The Infrastructure Investment and Jobs Act funding will drive this segment in 2024 and beyond. Additional activity is expected at the federal level to support almost $2 billion in federal prison infrastructure improvements.

EARLY '25 VIEW: +3.6% FMI Corp is projecting a 6% increase in 2025 with a volume of $17 billion. Dodge Construction Network is at +5.4%. However, Moody’s Analytics is more bullish at -0.3%.

PRO: After a strong 2023, The AIA Consensus Construction Forecast significantly lowered the projected growth in the industrial segment for 2024. However, it is still one of the most attractive construction segments projected for growth in 2024. The reshoring of manufacturing post pandemic and the continued push for more sustainable manufacturing processes are the drivers. Demand for semi-conductors, batteries, and alternative energy products plus ongoing electrification continue to drive the manufacturing segment. Federal funding is stimulating growth. The U.S. Census Bureau December 2023 report indicates a 60.5% increase in total manufacturing construction spending over the previous year. FMI Corp is forecasting 18% growth in 2024, accounting for $241 billion in spending.

CON: Interest rates remain higher than expected norms, and banks continue to tighten lending requirements. But ultimately, increased public infrastructure spending puts pressure on an already tight job market for available workers. Year-over-year spending levels off after 2024 but still accounts for well over $200 billion in activity.

BOTTOM LINE: Sustainability improvements to meet net zero and decarbonization and investments in automated processes to combat worker shortages drive a healthy manufacturing construction segment in 2024.

EARLY '25 VIEW: -0.8% Beyond 2024, there are economic uncertainties that continue as inflation remains a problem and overall U.S. consumer spending slows. The forecast provided by S&P Global Market Intelligence is calling for a 15.1% pullback in the industrial segment for 2025. FMI Corp is eyeing spending levels of $235 billion in 2025, $212 billion in 2026, and $202 billion in 2027.

PRO: The U.S. Census Bureau December 2023 report shows a 5.0% increase in total construction spending for lodging over the previous year. According to Hotel Investment Daily, there will be an 8% increase in hotel construction in 2024 with 2,234 new hotel projects and 274,616 total rooms planned for the year. FMI Corp is forecasting a 12% increase over 2023 at a $27 billion level of activity. FMI sees large owners and chains accounting for more than half of all projects through 2025.

CON: Rising operating costs (labor, utilities, etc.) combined with high financing rates force ROI models to rely on high room rate structures that may not meet consumer demand.

BOTTOM LINE: Forbes Advisor estimates that 40% of Americans plan to travel more in 2024 versus 2023. Travel – both leisure and for business – continues to increase post-pandemic.

EARLY '25 VIEW: +5.9% While the AIA Consensus Forecast anticipates a solid 5.9% increase in lodging construction, Dodge Construction Network, one of the AIA participating survey providers, is much more bullish in 2025, projecting an 18.5% increase over 2024.

PRO: The U.S. Census Bureau reports total education seasonally adjusted construction spending in December 2023, up 16.6% from a year ago. Within that segment, private education construction is up 18.5%, and public is up 16.1%. For 2024, FMI Corp is forecasting a 10% growth rate for the segment worth $132 million in activity.

According to K-12DIVE, design considerations for K-12 schools revolve around enhanced security, spaces to support career and technical education, adaptability for fluctuations in enrollment, and sustainability considerations such as EV charging stations, and energy-efficient features that contribute to carbon reduction.

CON: Rising construction costs, combined with enrollment challenges and securing sources of funding in a timely manner present barriers to growth. But those problems are not unique to 2024, and projects in the education segment tend to be rather consistent year-to-year based on need and strong community/institutional planning.

BOTTOM LINE: Both the education and healthcare segments are reliable performers when it comes to infrastructure activity. The education industry is rebounding from pandemic-era project delays. While online and hybrid enrollment continues to trend, expect infrastructure investment to be buoyed by federal incentives to upgrade toward clean energy solutions.

EARLY '25 VIEW: +3.9% FMI Corp is projecting an additional 5% in growth for 2025, followed by more modest 2% growth in 2026 and 2027.

PRO: This segment continues to demonstrate growth potential. The U.S. Census Bureau reports a 10.8% year-over-year growth in December 2023. This growth was driven by public construction projects growing 20.6%. This can be attributed to public-funded sports arenas – both new construction and refurbishments – and other taxpayer-funded developments as urban areas look to transition into entertainment hubs to make up for lost office worker populations. These entertainment hubs are meant to be year-round attractions. Building Design & Construction lists 12 U.S. markets where this is occurring or being considered. For 2024, FMI Corp projects a 7% growth rate on a $36 billion level of activity.

CON: The U.S. Census Bureau indicates private construction in this segment to be relatively flat at 1.9% year-over-year. More stringent lending policies and high interest rates continue to impact private investment.

BOTTOM LINE: Expect public activity to be consistent over the next few years as urban areas continue their transformations into entertainment hubs. Private investment should follow, especially as interest rates stabilize and are even expected to go lower in 2024.

EARLY '25 VIEW: +3.1% According to FMI Corp, amusement and entertainment construction is forecast at a 0% rate in 2025 and is expected to retract by 6% in 2026, with another 2% retraction in 2027, shrinking the category to $33 billion.

PRO: The healthcare industry continues to grapple with staff shortages as an aging population (particularly with the Baby Boomer generation) requires more demand for services. There is still an emphasis on micro-hospitals and medical clinics in suburban and exurb geographies. Regarding hospital, the Healthcare Business Review sees facilities focusing on enhanced entry points. During the pandemic, the need for better pre-screening protocols became apparent. Facilities are now focused on improving entry space such as waiting rooms with increased space for social distancing, lower-height walls with glass partitions, better filtration systems, and using technology to better identify elevated temperatures. The design of senior care facilities today is considering more lifestyle amenities like walking trails, work-out facilities, and technology rooms to accommodate a more active boomer population.

CON: Hospital business margins continue to be strained as operating costs, especially for high-skilled employees, remains competitive.

BOTTOM LINE: The U.S. Census Bureau shows a total of 14.0% in year-over-year growth in total seasonally-adjusted healthcare construction in December 2023, with public investment driving the activity at 15.2% growth year over year, while private accounted for 13.6% growth. Healthcare is a segment offering consistent growth opportunities year after year for building materials brands to cultivate. FMI Corp is bullish on healthcare in 2024, projecting 8% growth and $68 billion in construction activity.

EARLY '25 VIEW: +3.5% Expect modest and consistent growth with healthcare clinics and suburban medical office buildings to fuel growth in this segment. FMI Corp suggests 4% growth in 2025 before flattening out at 0% in 2026 and -1% in 2027.

PRO: The U.S. Census Bureau, December 2023 report shows the seasonally adjusted annual rate for religious construction up an impressive 31.3% from the previous year. The AIA’s July 2023 forecast of 8.4% anticipated growth here, and it came to fruition. The reason for the gains? Likely renovation activity to reimagine multiuse spaces, along with demographic shifts to new markets, spurring the need for new facilities.

CON: A small overall volume of activity annually. In general, religious institutions are facing changing cultural norms whereby younger generations are less active or involved in terms of church affiliation.

BOTTOM LINE: It was a surprising performance in 2023 that will be hard to replicate moving forward. FMI Corp forecasts the annual volume of activity to be a consistent $4 billion, with 2024 expected to realize a modest 4% gain.

EARLY '25 VIEW: +1.0% Remains flat and/or declining over the next few years.

PRO: Consumer spending remained strong in 2023, giving momentum for the retail sector. Population shifts across the U.S. will provide some opportunity for growth. The U.S. Census Bureau December 2023 report shows the seasonally adjusted annual rate for total commercial construction spending to be up 1.4% in December from December of 2022.

CON: FMI Corp. projects a decline of 4% in the overall retail and commercial category for 2024, as warehouse construction represents over half of the category and is expected to slow down. Store closures and bankruptcies also weigh down this category, and large retailers continue to shift to a stronger balance of e-commerce business.

BOTTOM LINE: Expect contraction. 2023 activity was projected to be at $133 billion but is expected to decline to $127 billion in 2024.

EARLY '25 VIEW: -0.4% FMI Corp. shows continued pressure on retail and other commercial in 2025 with an 8% decline. After a flat 2026, the segment is expected to improve from $119 billion to $127 billion in 2027, a 6% increase.

PRO: The U.S. Census Bureau suggests that office construction finished well in 2023 with a 5.3% increase in total construction when comparing December 2023 to the previous year. While inflation is still slightly rising (but at a decelerated rate), the Fed has indicated the possibility of multiple rate decreases in 2024. This will help developers avoid defaults and may even remove barriers for near-term investment. Is that enough to counter-balance the impact that work-from-home policies are having on vacancy rates and the desire for smaller office footprints?

CON: An article in the Wall Street Journal from January 30, 2024, suggests that new office buildings will represent only 1% of total inventory through 2027, the lowest level in more than 25 years. FMI Corp. is projecting a modest 2% decline in overall activity for 2024.

BOTTOM LINE: While tenants are downsizing footprints, they are also upgrading to better space. Class-A space remains quite competitive. Activity in more convenient suburban office campuses remains solid. Cities and investors are still figuring out adaptive reuse ideas for vacant downtown buildings.

EARLY '25 VIEW: -0.7% As long as interest rates remain high, there will be headwinds for developers and business owners. Renewing commercial mortgages at rates far higher that the original term is unattainable, especially as vacancies disrupt tenant revenue flow, resulting in declining building values. FMI Corp. sees a 5% decline in 2025 but leveling off in 2026 through 2027, likely on the hopes of more attractive interest rates.

Let’s talk.

Have a specific marketing challenge? Looking for a new agency?

We’d love to hear from you.