Commercial Construction Forecasted for a Bullish 2022

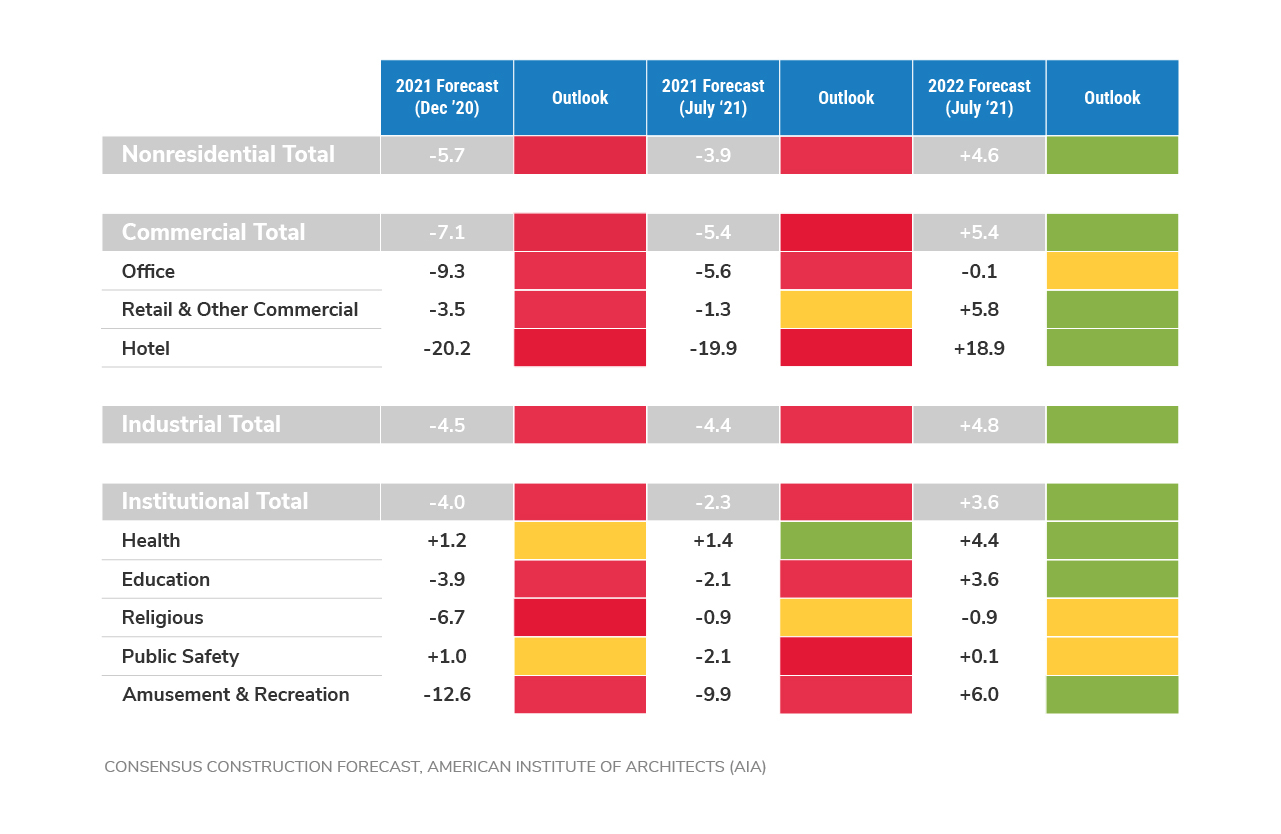

After weathering quite the storm amid the global pandemic, the commercial construction market is showing signs of strength as 2022 approaches. The AIA’s semi-annual consensus construction forecast is projecting a growth for almost every segment of the commercial construction market. Leading the way is an anticipated rebound for the building of hotels and resorts, with an 18.9% projected growth.

Many Commercial Segments Look to Rebound in 2022

Here’s a look at each segment, ranked by their expected growth.

Hotels & Resorts: +18.9%

PRO: Vaccination rates continue to rise, and most U.S. consumers are realizing it is time to get on with life and manage through this seemingly never-ending virus. As a result, travel and vacationing is once again capturing the American entertainment dollar. While homeowners spent money during COVID renovating and expanding their homes, they are now signaling that it is time to get away from the home for a change of scenery.

CON: Finding staff to work at the hotels and resorts is an ongoing problem. And travel continues to be tough when coupling COVID restrictions with airline staffing shortages. While business travel is beginning to return, the mindset for traveling may have changed as corporations have become accustomed to low travel and entertainment expenses. Video conferencing seems to have replaced much of the frequent need to be in person.

BOTTOM LINE: This segment was hit the hardest and is only now recovering, so the 18% growth is partially the result of starting with a low benchmark. There are strong tailwinds for immediate hotel & resort construction growth, but proper hotel and airline staffing could quickly dampen the traveler experience, putting strains on this segment moving forward.

Amusement & Recreation: +6.0%

PRO: Stuck at home with lockdowns with many working from home, homeowners became aware of blemishes and invested in home improvement in an incredibly aggressive manner – swimming pools, outdoor patios, kitchens, quiet office spaces, exercise rooms, and more. Then came the product shortages. And then the outrageous cost of lumber over the summer as more communities started opening restaurants, concert venues, etc. Suddenly, home improvement was getting too expensive and burdensome, and the “share of wallet” switched more toward the experience – ballgames, dinners, concerts, and visits to other public gathering spaces.

CON: This segment was among the hardest hit by the pandemic, with most entertainment venues either canceling seasons or significantly limiting attendance. This had a huge impact on profitability and may limit how much investment is ready to move forward short-term. Additionally, the worker shortage is hitting this category hard.

BOTTOM LINE: Sports and other entertainment venues are returning in full force. College and pro football are filling stadiums weekly, and other entertainment venues are returning to post-COVID programming and attendance levels. While the forecast is positive for 2022, the reality is that investment may require more time to mend and so that the sector can put itself in a position for real growth.

Retail & Other Commercial: +5.8%

PRO: Lockdowns and closures are unlikely to happen again as we learn to live with the ongoing effects of the virus. People yearn for a return to the experience – shopping, eating out, and visiting new retail-based outlets. The local outdoor strip mall is still a desirable means for adding to the community. Restaurants are building with outdoor seating in mind.

CON: Beyond the ever-evolving, ongoing tension with online shopping, the most significant threat to retail construction is two-fold: Ongoing product shortages, and a lack of available workers. Both can significantly impact growth potential and decisions about construction expansion.

BOTTOM LINE: Community-based retail construction should be strong in 2022 and beyond. As residential home-building continues to grow, the need for retail and restaurants within those communities will follow.

Industrial: +4.8%

PRO: The supply chain pressures the U.S. is currently feeling magnify the need for more investment in domestic manufacturing. There is a desire to bring more production within the borders to alleviate dependency on imports and related shipping constraints. It involves everything from raw materials to finished goods. The need for increased industrial construction is apparent, and the passing of the infrastructure bill will exasperate this need.

CON: Manufacturers are flush with cash and ready to make the infrastructure investments. The largest obstacle continues to be workers. It is a highly competitive market for manufacturing talent as the pandemic initially led to layoffs. The returning pool of workers has shrunk due to continued COVID concerns, workers embarking on a different career path, and a large Baby Boomer population who used the pandemic as a trigger for retirement.

BOTTOM LINE: The need for domestic manufacturing is clear, and manufacturers are ready to invest. A lack of available workers will limit just how much production this new capacity can handle in the short term, but the investment is considered a long-term play.

Health: +4.4%

PRO: The pandemic has certainly highlighted the need for increased investment in manufacturing of everything from pharmaceuticals, masks, and other preventive goods and services. The capacity of hospitals has been stretched throughout the crisis. On the horizon, there are other macro-trends to consider. A large and aging Baby Boomer population highlights the need for long-term care facilities, additional hospital infrastructure, and healthcare equipment production. Healthcare systems are expanding their physical footprints and market share by investing in community-based mini-hospitals and additional patient touchpoints. The infrastructure bill calls for significant investment in healthcare services.

CON: Healthcare has also been affected by a shortage of workers and supply.

BOTTOM LINE: Changing demographics and care expectations mean there is a strong opportunity in 2022 and beyond for the healthcare construction segment.

Education: +3.6%

PRO: According to the 2021 FMI North American Engineering and Construction Outlook, 4th Quarter 2021, growth in this segment will be stable in 2022, with extended growth of 5-7% annually through 2025. Look for the strong growth in residential single-home construction to fuel elementary and secondary education facility construction in those growing markets, mainly suburban and exurban geographies. A full return to the classrooms in 2022 – along with expected federal investment in facilities upgrades like better filtration, airflow, etc. – bodes well for construction health in this segment. Private schools could also see infrastructure investment as a means for maintaining enrollment momentum due to ongoing concerns with public school policies related to COVID and other national themes.

CON: Many urban elementary and secondary schools continue to feel budget pressures that have increased due to the pandemic. Higher education saw 2020 and 2021 enrollments decrease, while a shift to virtual learning proved to be a less-profitable revenue model. According to the FMI report, 2021 spring enrollments fell 3.5%, with 65% of losses centered on community colleges.

BOTTOM LINE: The needs for K-12 upgrades are real and, in many cases, can no longer be pushed off. The pandemic stimulus provided local governments with financial support to help improve K-12 facilities, and the infrastructure bill calls for significant investment to this end. Colleges and universities may be more challenged to find investment in the short term.

Public Safety: +0.1%

PRO: The FMI study calls out added federal investment resulting from the pandemic stimulus dollars. Many local governments are just now earmarking those dollars for new facilities and upgrades. Greater attention is being given to social programs for homelessness and mental health, which may require increased investment in physical buildings.

CON: While stimulus dollars have been distributed to many of the major cities, it is uncertain as to how much will be used for buildings. The passage of the infrastructure bill certainly helps.

BOTTOM LINE: The funding is there for major cities to invest in infrastructure. It is a matter of identifying those cities and administrations who are prioritizing building and facility construction over roads and bridges in their near-term budgets.

Office: -0.1%

PRO: Opportunities exist in developing office space within convenient boundaries of lower-cost suburbs, which make it easier for employees to commute. Less expensive, less regulated metros have become more attractive to corporations looking to save on real estate costs.

CON: Occupancy rates remain low, especially in the more expensive, large metros. A worker shortage has created an intensely competitive talent war with working from home being a major negotiating chip to recruit talent.

BOTTOM LINE: The pandemic will have a lasting impact on office space. A sudden shift to a prolonged work-from-home model has changed what workers and employers value in a work-life balance. While workers continue to return to the office, it is commonly built around some sort of hybrid home/office model. And businesses discovered a new-found liberty away from investing in large and high-end space.

Religious: -0.9%

PRO: Perhaps vacant existing buildings like retail, motels, and some office space might make for strong retrofit opportunities for growing religious groups needing larger space.

CON: The FMI study cites 2021 Gallup research indicating the U.S. is currently experiencing the lowest levels of Americans belonging to a church. Additionally, the pandemic forced technology adoption for congregations to gather remotely.

BOTTOM LINE: Of all the nonresidential segments, religious is the least likely to see any real traction in 2022.

Let’s talk.

Have a specific marketing challenge? Looking for a new agency?

We’d love to hear from you.