The third in a series of articles from BLD Marketing takes a closer look at residential homebuilding and remodeling in the midst of the global pandemic and how COVID-19 has played a role in new trends.

COVID-19’s ripple effects on the building materials category are expected to be significant, impacting the construction market for months and potentially years to come. Part One of “COVID-19 and the Building/Construction Industry: Risk, Uncertainty and Opportunity” viewed the pandemic’s impact from the perspective of the building category’s decision makers and influencers. Part Two delved into the various segments of the commercial and institutional building materials category, identifying opportunities, threats, and expectations moving forward.

What about the residential construction market? Part Three of the series examines how the pandemic is impacting single-family homes – from new construction to home improvement trends.

Single Family Residential Housing Continues to be a Major Bright Spot in Construction

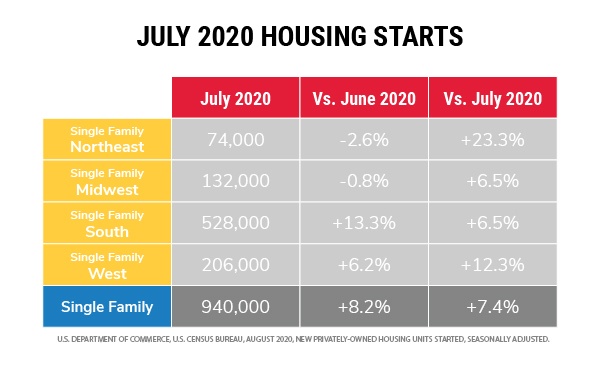

Single-family housing showed an upward trend in July (+8.2% from June) and outpaced activity from a year ago (up 7.4% from July 2019). Regionally, the South accounted for the heaviest volume of activity and headed into positive territory versus June 2020 and when compared to 2019. While the Northeast is slightly down from June, it owns the highest year-over-year regional increase at 23.3%. The West shows positive short-term trends, but single-family growth is lagging from a year ago (down 6.8%). The Midwest is pacing above 2019 activity.

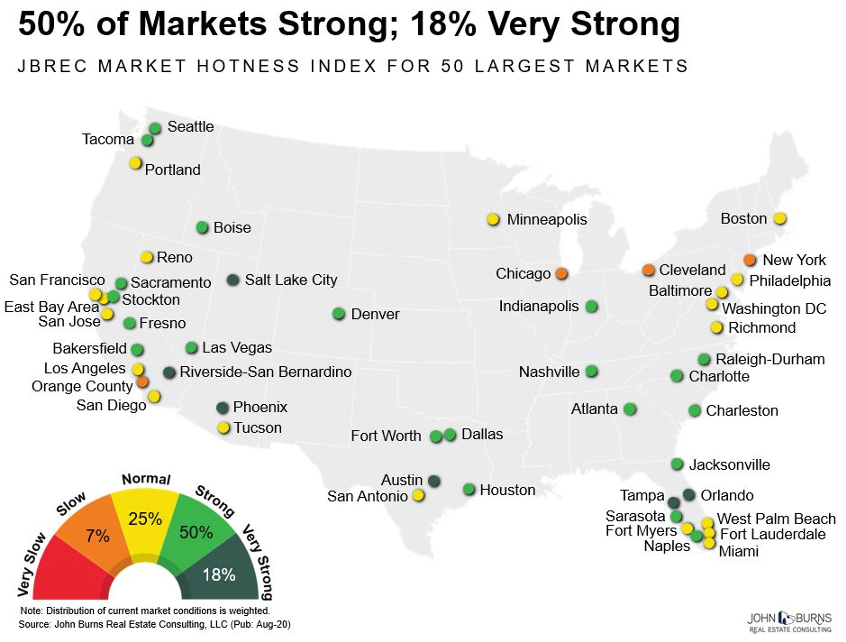

Breaking down the current hot new home markets across the U.S., John Burns Real Estate Consulting shows that 68% of the residential market is currently either strong or very strong for the top 50 geographic markets.

While it is too early to make any evaluations on COVID factors impacting migration away from more expensive metro hubs, a number of factors are stimulating demand in housing. These include low interest rates, a new appreciation for suburban and rural markets, and growing young millennial families. Expect renewed single-family construction in suburbs to integrate more community features and amenities found in the urban environment – sidewalks, walkable retail, mixed use multi-family developments and single-home developments.

Home Improvement Continues to be Strong

Overall, travel has seen a marked decrease during the pandemic. That means people are spending less time on vacation and more time at home. Simultaneously, many continue to work from home. A significant increase in home improvement suggests people are finding a need to improve or reimagine their space and are reallocating dollars that might normally be spent elsewhere .

The U.S. Census Bureau reports home centers, hardware stores, garden centers and building materials suppliers saw a 22.6% year-over-year sales increase through July. HBS Dealer reported strong second-quarter comparable store gains for the big box retailers:

- +35% Lowe’s

- +25% The Home Depot

- +35% Ace Hardware

Houzz, a leading platform for home remodeling and design, reported a 58% increase in U.S. project leads for home professionals during the month of June, compared to the same period in 2019. Porch.com, another leading platform focused on connecting homeowners with a variety of home-related services, shows that 76% of U.S. homeowners have carried out at least one home improvement project since the start of the pandemic. At the same time, 78% are planning another over the next 12 months.

What is Motivating Homeowners to Improve Their Space?

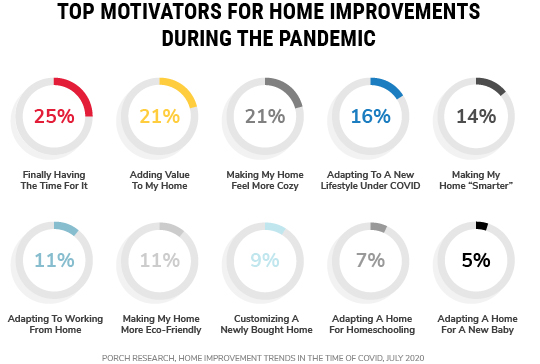

COVID is certainly re-energizing home improvement activity, but what is the homeowner’s motivation? What are they actually renovating? Porch.com recently published their own study, Home Improvement Trends in the Time of COVID, 7/21/20 Porch COVID Home Improvement.

Here are some of the findings:

- 55% of U.S. homeowners said the COVID disruptions gave them time to improve their homes; while 59% stated that spending more time inside due to the lockdown was the inspiration to renovate.

When asked about the top motivator that led to their home improvements since the start of the pandemic, time and adding value were the top choices.

What Type of Home Improvements are Most Popular?

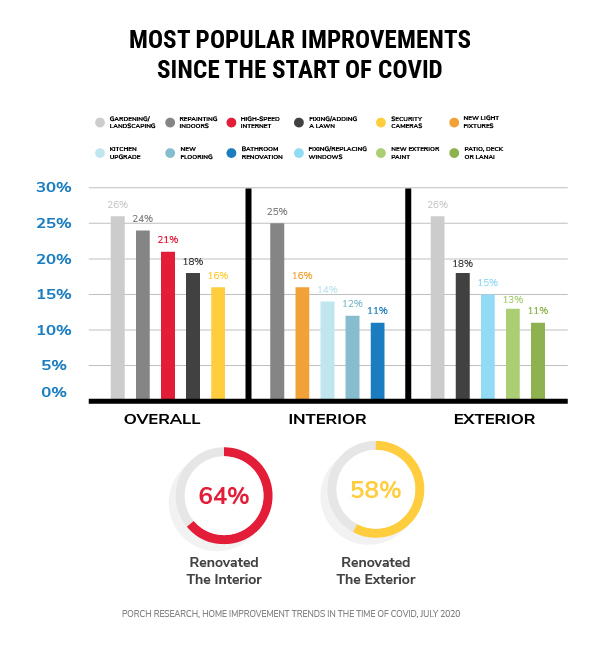

Exterior projects were more popular since the start of the pandemic. This tracks with an historic trend of homeowners choosing to work outside at home with the arrival of spring and summer.

Most Popular Improvements Since the Start of COVID:

More time spent at home due to the pandemic drove many to reevaluate their living space and its accommodations – everything from outdated paint to a slower internet connection. At the same time, homeowners are cocooning, spending more time co-existing for a full day with a spouse and children. That has driven a shift in value systems. People are placing a higher premium on larger improvements – a clearly defined office space, a home gym, or a kitchen upgrade with antimicrobial surfaces to meet the renewed passion for cooking. It might even mean an improved and expanded outdoor living area to accommodate the family being home more often.

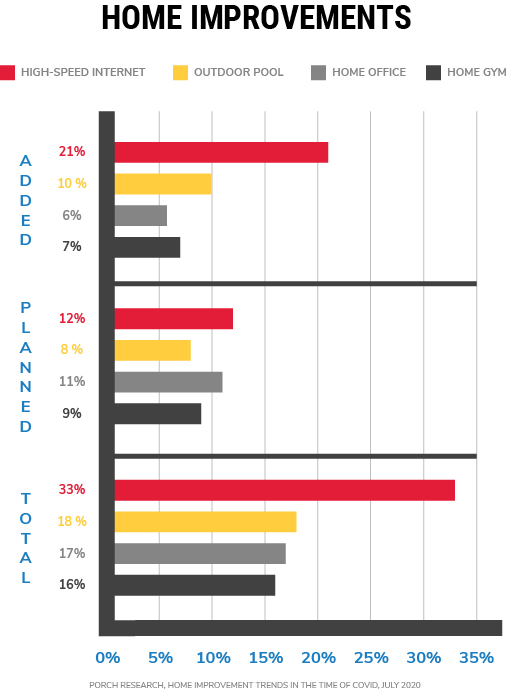

What Type of Home Improvements Have Been Made Since the Start of COVID, and What is Planned for the Next 12 Months?

The pandemic is fueling uncertainty around employees returning to work and children fully returning to school. Many large employers are delaying full-time return to offices until 2021. Other employers are discovering how working from home has increased productivity as employees remove drive times and create flexibility to be more effective. Many employers have committed to permanent work-from-home arrangements extending beyond the pandemic.

This all fuels a longer-term view for homeowners to invest in their home or look to build or purchase a new one. Making the decision to invest in larger projects such as swimming pools, kitchen upgrades, home gyms, and even in-home classrooms equipped with large screens and whiteboards to accommodate virtual learning become sensible investments. And hesitation to gather in public spaces and restaurants has resulted in homeowners rediscovering a simpler, rewarding lifestyle, investing their time and dollars where today they are most comfortable - at home.

Let’s talk.

Have a specific marketing challenge? Looking for a new agency?

We’d love to hear from you.