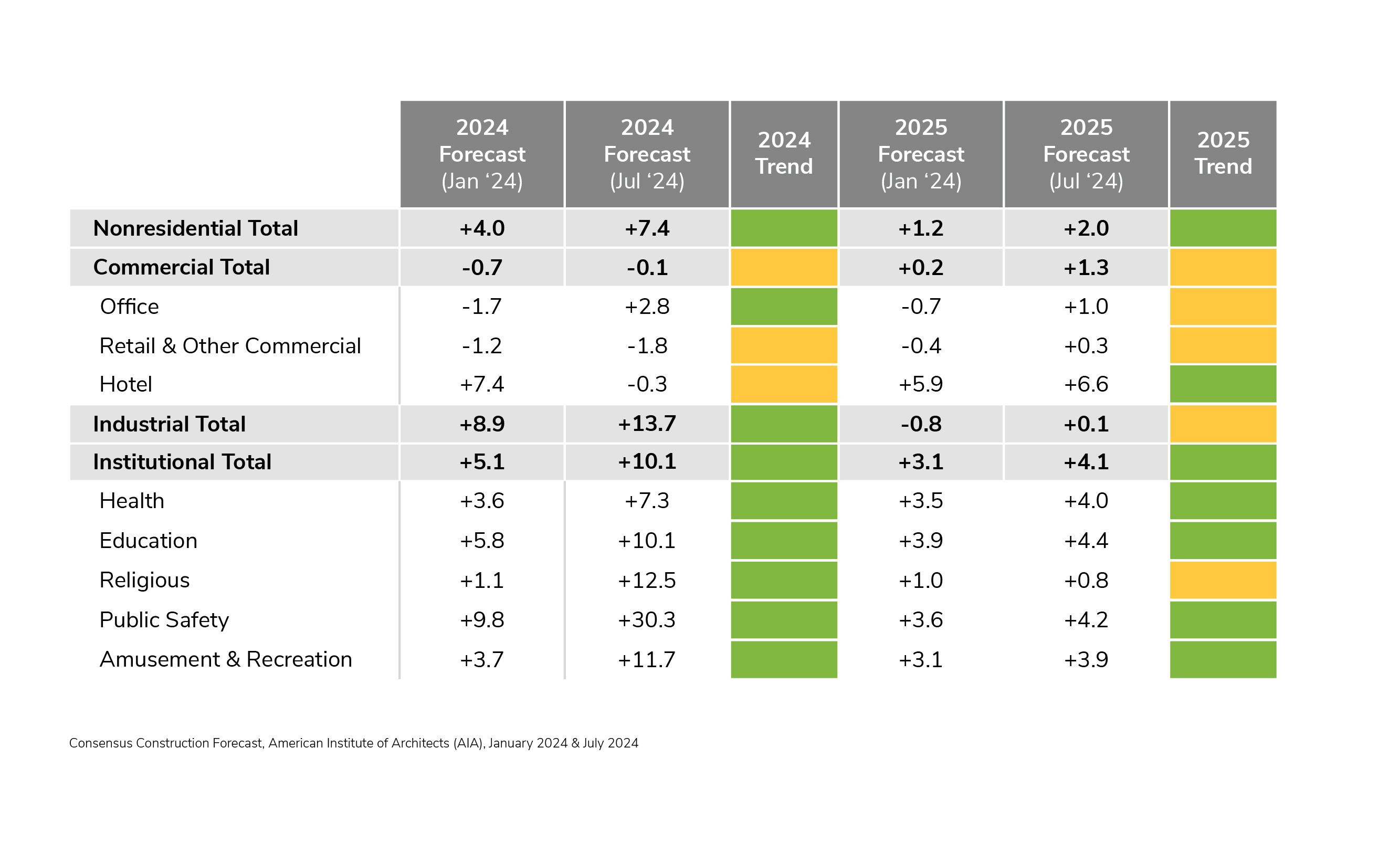

Mid-Year Update – July 2024

There are several sources providing forecasting data on the state of the commercial building and construction industry. One of the best known is the American Institute of Architects (AIA), which publishes a consensus construction forecast twice a year. Learn more about their outlook along with insights from some of the other leading construction industry prognosticators, some of whom are part of the AIA’s aggregate data.

The Next 18 Months Show Promise

Here’s a look at each segment, ranked by their expected growth in 2024 and into 2025, along with an extended five-year forecast view and insight.

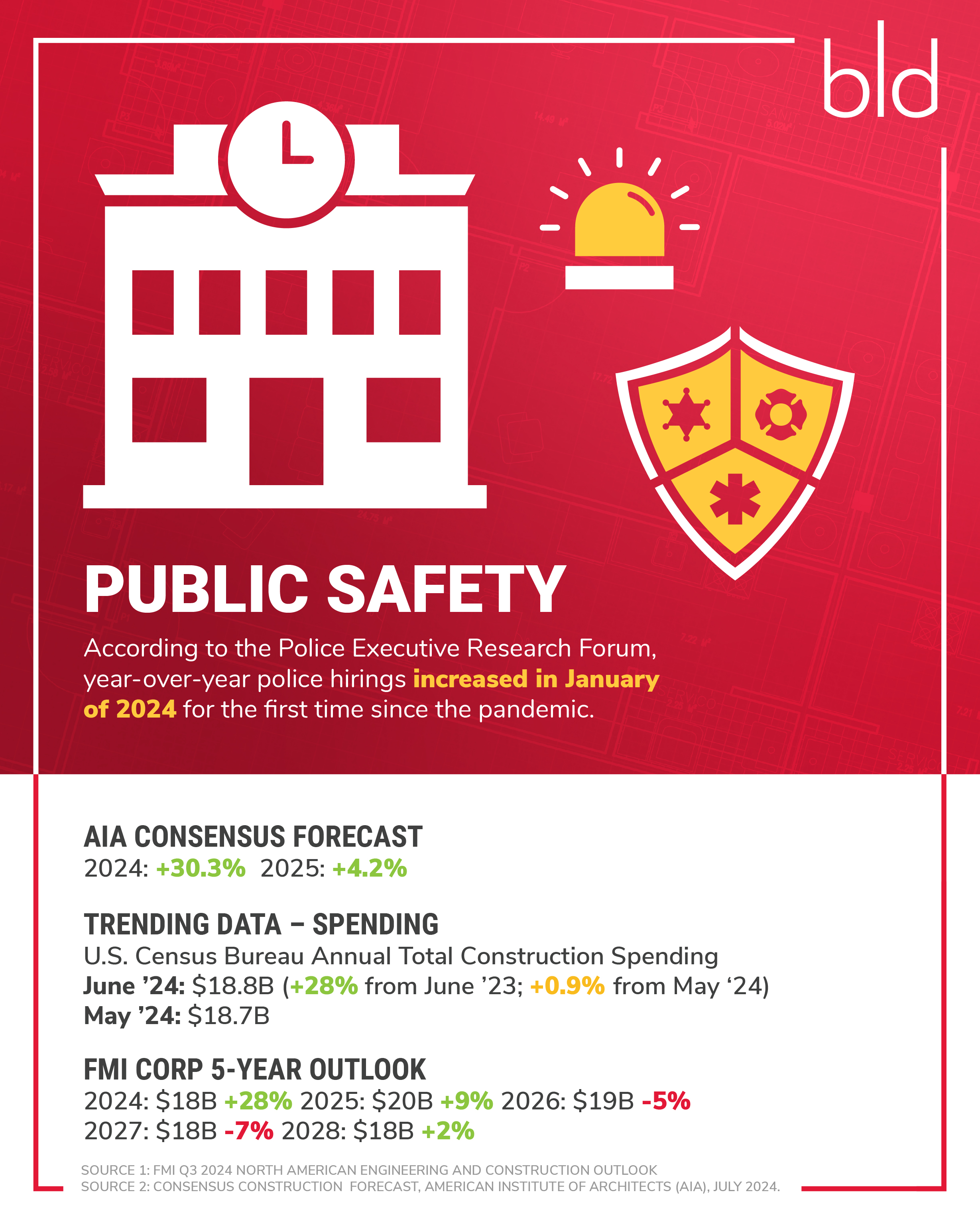

PUBLIC SAFETY

OPPORTUNITY: Shifting populations drive the need for new public safety facilities in growing metros and suburban markets. Building consolidation in declining population markets also drives new construction or the rehabbing of existing facilities.

CHALLENGE: Governmental decision making and fund approval cause delays on projects while construction costs continue to rise, creating the need to adjust and account for additional investments.

INDUSTRIAL & MANUFACTURING

OPPORTUNITY: Emerging technology and the transitional economy are creating opportunities in the manufacturing of semi-conductor chips, clean energy, electric vehicle vehicles, batteries, and recharging infrastructure.

CHALLENGE: Beyond government-sponsored domestic manufacturing initiatives, growth in U.S. manufacturing output is still challenged by global competitive pressures.

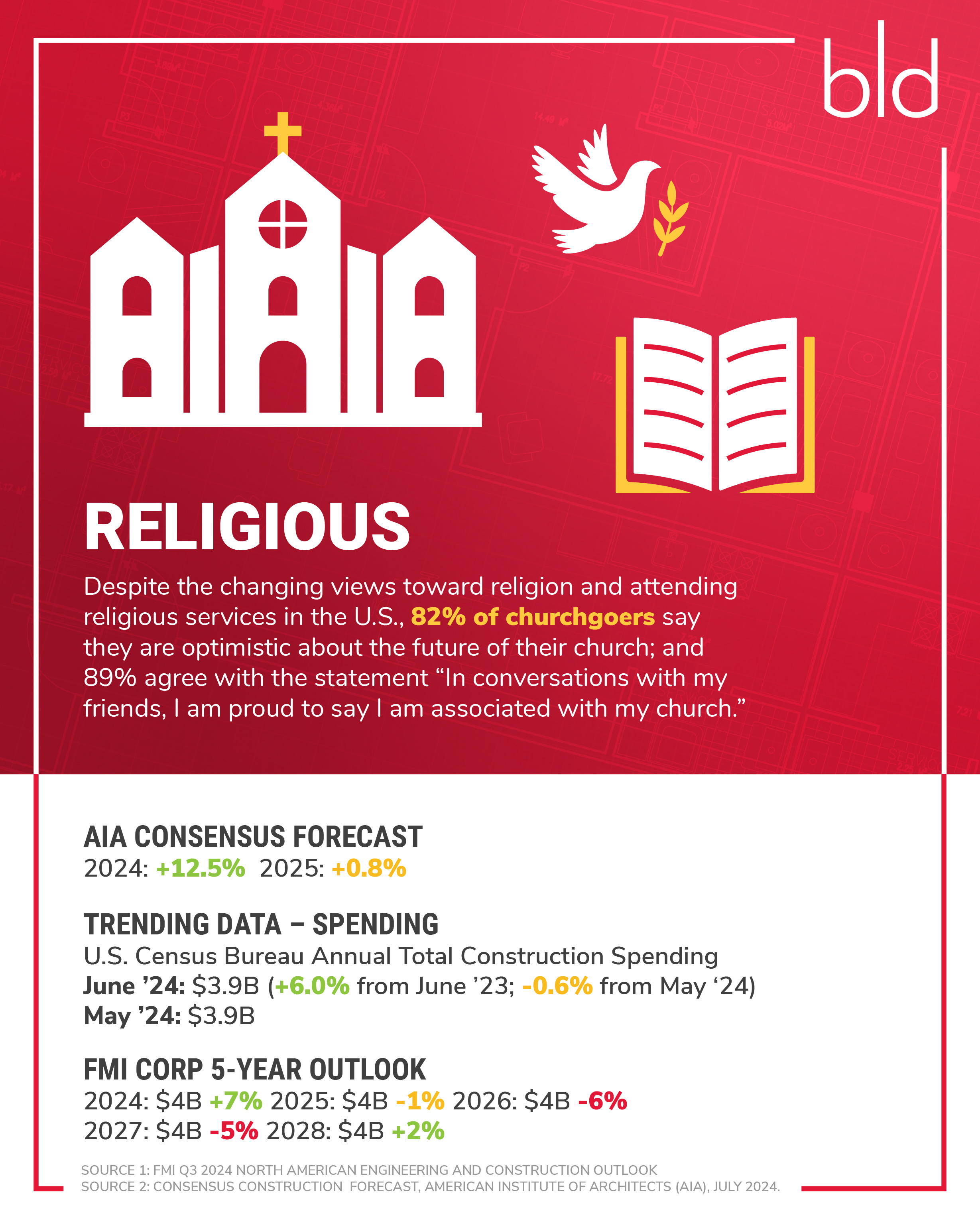

RELIGIOUS

OPPORTUNITY: Construction activity for 2024 shows promise, likely due to significant population shifts to southwestern and southern markets, fueling new community growth. Under-utilized churches are getting creative in renovating portions of their facilities to help with the housing crisis in some metros.

CHALLENGE: Regular attendance of religious services continues to decline as U.S. consumer values shift with the millennial and Gen Z generations.

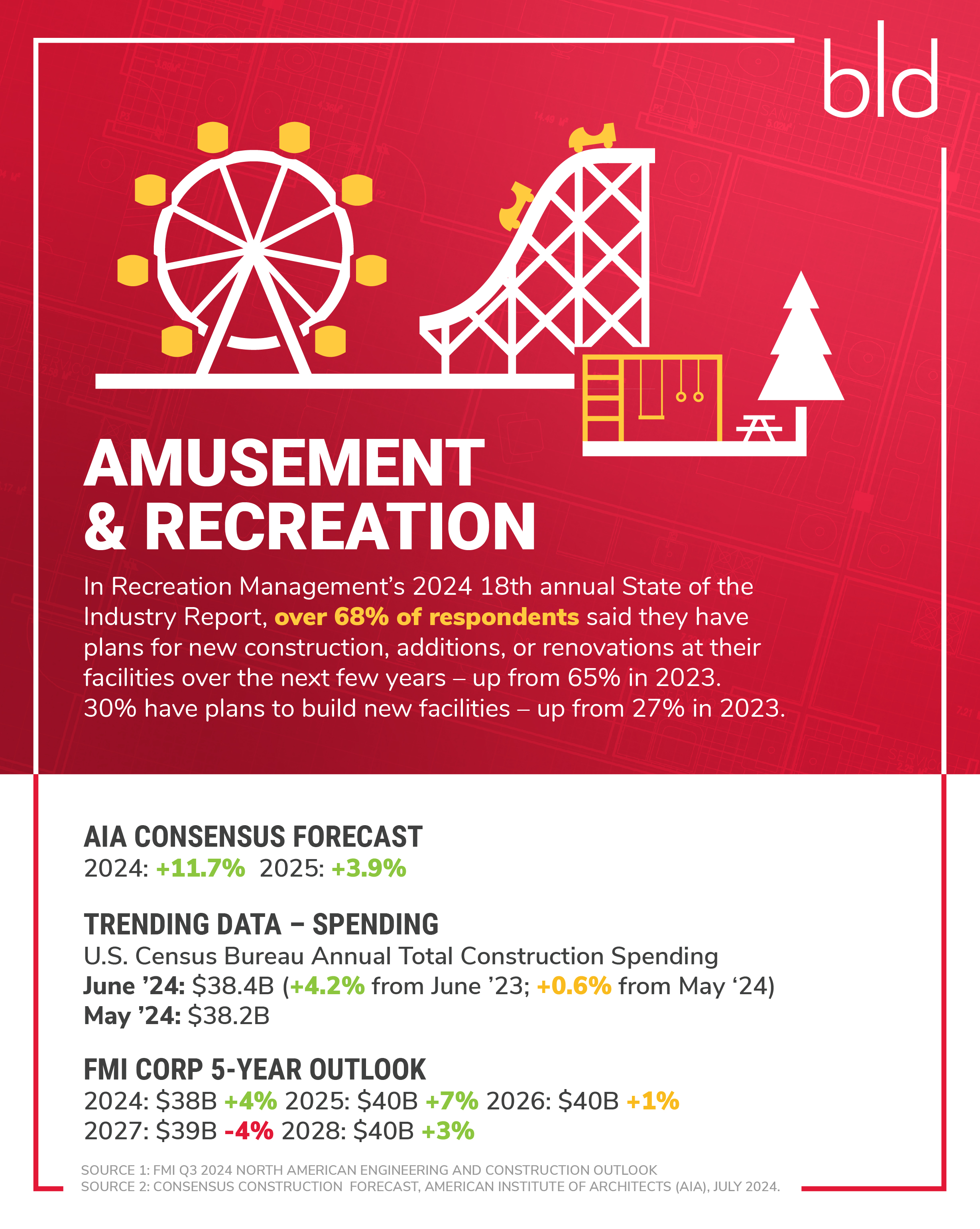

AMUSEMENT & RECREATION

OPPORTUNITY: Post-pandemic, the demand for entertainment, sports, and recreation has been strong, leading to investments in all forms of facility development.

CHALLENGE: Economic uncertainty with persistent inflation, high interest rates, and recession fears may stunt future growth patterns, but the five-year outlook remains solid.

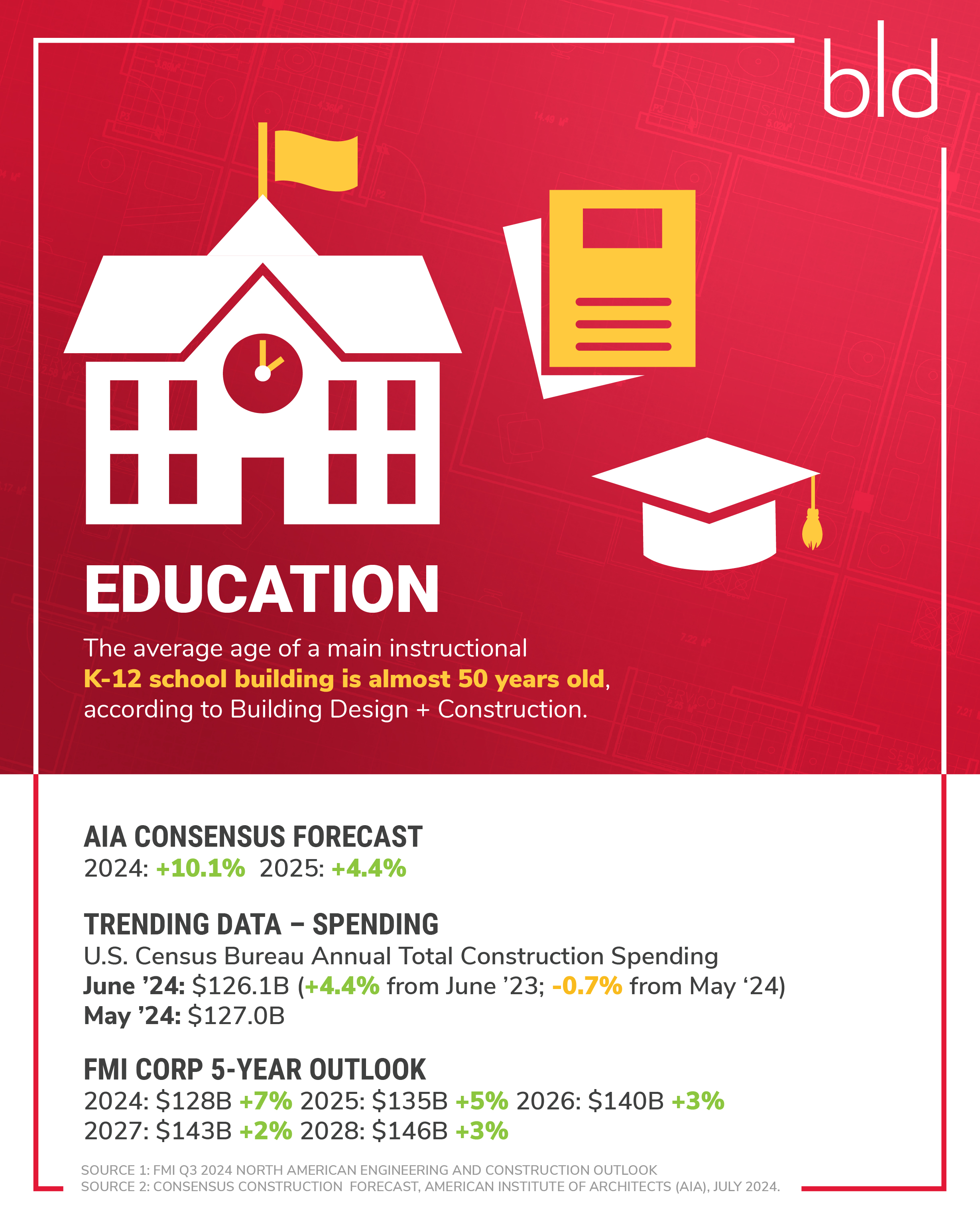

EDUCATION

OPPORTUNITY: Demand for student housing is high for colleges and universities as colleges typically only plan for 25-35% of mainly underclass students living on campus, while nearby off-campus rates are rising to unaffordable levels. For K-12 facility development, health, wellness, air quality, and net zero energy goals are the trend.

CHALLENGE: Economic uncertainty with persistent inflation, high interest rates, and recession fears may stunt future growth patterns, but the five-year outlook remains solid.

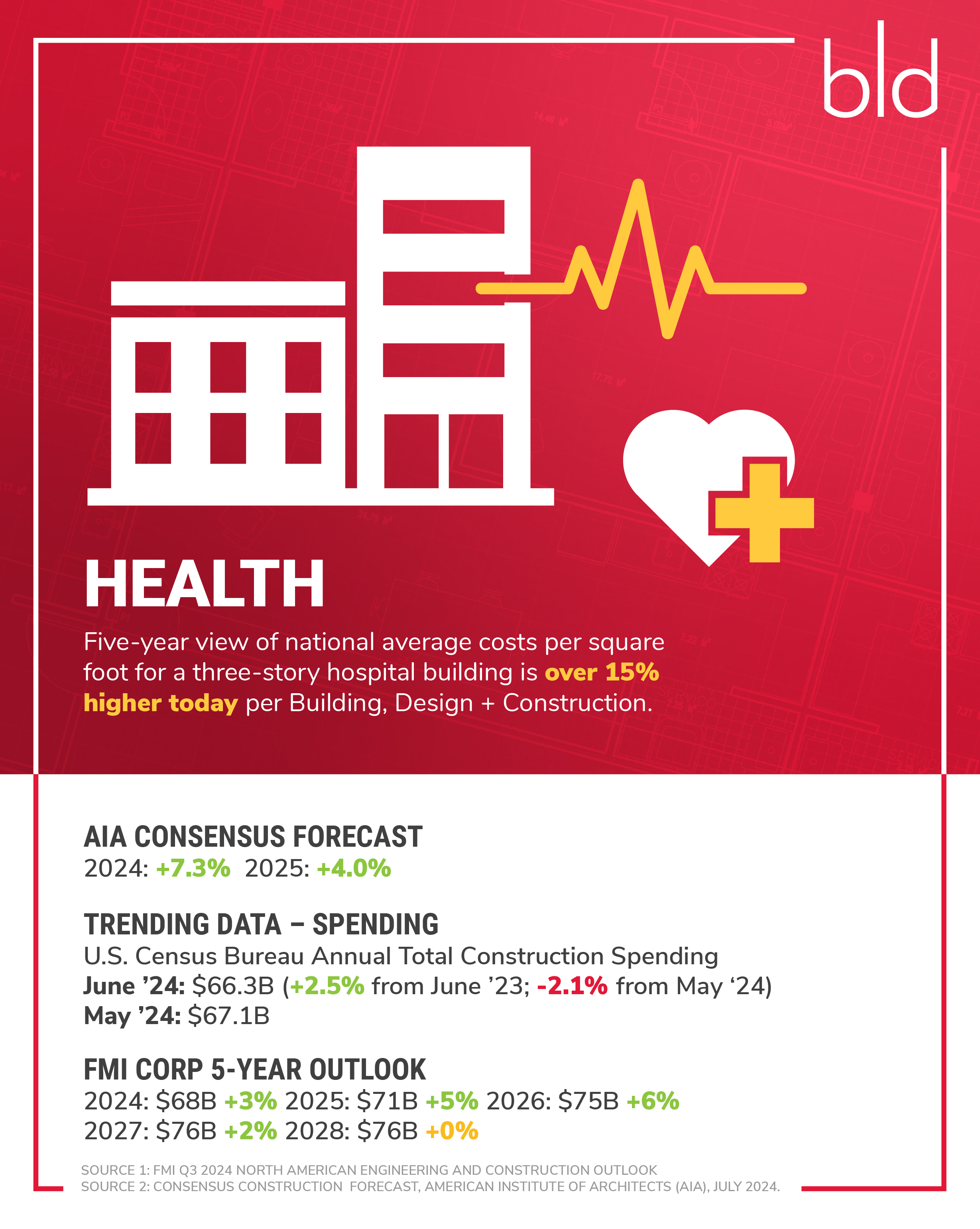

HEALTH

OPPORTUNITY: Growth in outpatient care in suburban, nonhospital campus settings is driven by aging populations looking for easier access, overall convenience without sacrificing quality, and the availability of technology and specialists.

CHALLENGE: Rising construction costs remove some predictability in planned capital projects leading to construction delays and renewed funding efforts for healthcare organizations already working with tight operating margins.

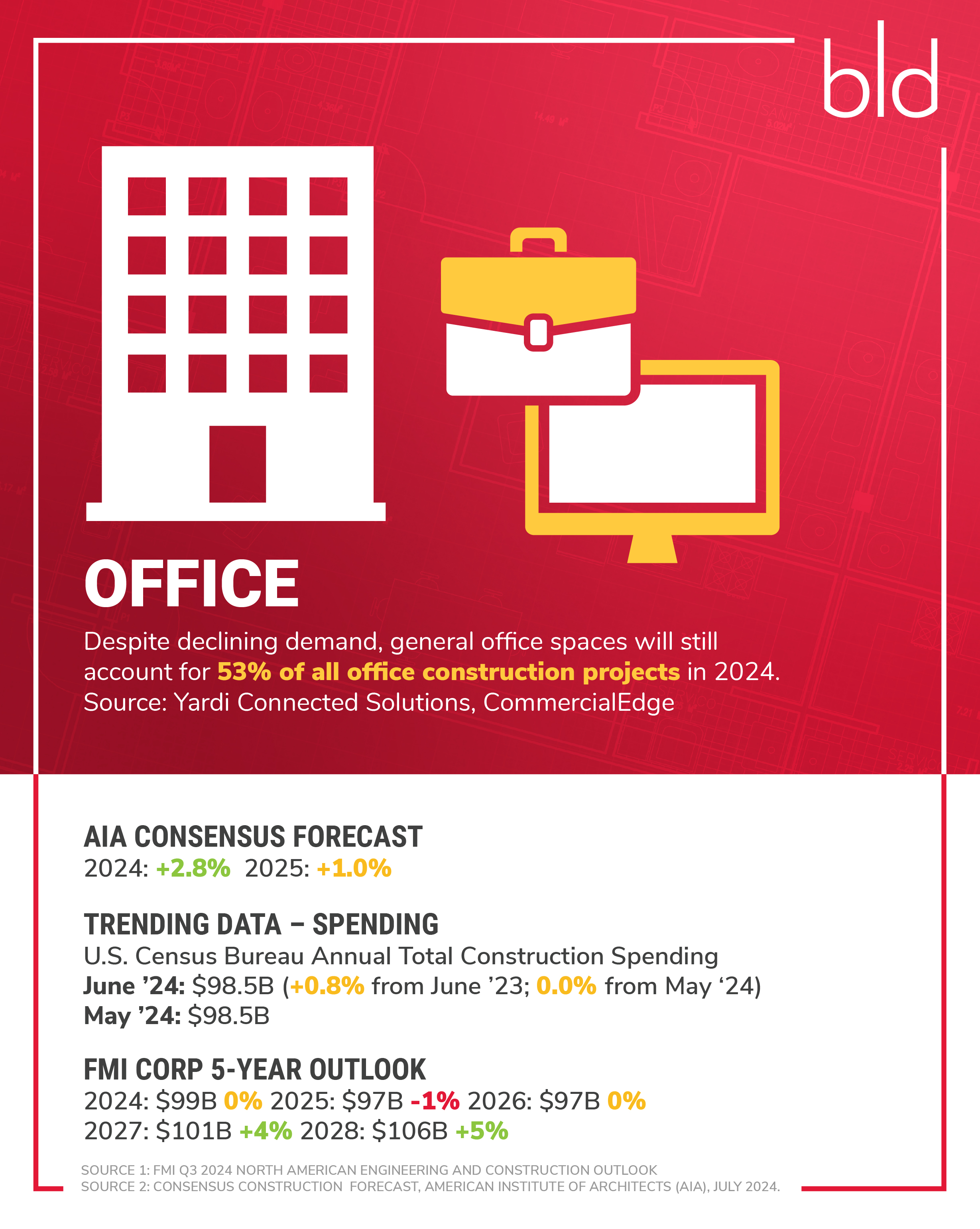

OFFICE

OPPORTUNITY: Office construction in suburbs is a good comprise to build affordable, convenient spaces to motivate more in-office requirements. The combination of new Class A suburban space and renovated older buildings in urban and older suburbs with attractive amenities and a welcoming experience will drive demand in the near term.

CHALLENGE: The pandemic created a paradigm shift in attitudes toward work. Work from home is an expectation for professionals, at least as a hybrid model. Metro downtown office spaces must re-imagine use around being livable entertainment hubs. Outside of the major handful of metros, high-rise conversions are costly. Plus, is there sufficient demand for people to live in downtowns if their jobs don’t require them to be there?

HOTEL & LODGING

OPPORTUNITY: Prefab construction helps reduce costs and shortens timelines while requiring less reliance on an already over-extended construction labor force. Automation technology reduces reliance on hospitality staffing while improving the overall stay experience, personalizing it for the guest.

CHALLENGE: Inflation-driven price increases to rooms and travel, unreliable airline performance, and weakening economic data put pressure on demand momentum moving forward.

RETAIL & OTHER COMMERCIAL

OPPORTUNITY: The migration of population to states like Texas, Florida, and Idaho presents opportunities in those growing geographies to foster both residential and commercial development, including retail.

CHALLENGE: Mixed use development, including multi-family components, may experience contracting demand due to stricter bank lending policies and continued high borrowing costs.

Let’s talk.

Have a specific marketing challenge? Looking for a new agency?

We’d love to hear from you.