PART ONE: Architects, Contractors and Building Owners

This is the first in a series of articles from BLD Marketing that takes a closer look at how key players in the building and construction industry are weathering the global pandemic and how COVID-19 may fundamentally change the design and construction of buildings of all kinds.

There is no escaping a fundamental truth when it comes to COVID-19: It will have a dramatic impact on the lives of Americans and on the nation’s economy for some time to come. This includes the building and construction industry and its many stakeholders, who increasingly realize they must adapt to rapidly changing circumstances so they can mitigate risks to their business and capitalize on opportunities.

An analysis of key industry metrics from the first half of 2020 highlight certain trends across several key professions – architectural firms, contractors, and building owners. Those trends provide visibility into where we could be headed in terms of a recovery and how the “new normal” might take shape.

Architectural Firms: A Rising Tide

The COVID-19 pandemic impacted architects significantly in April. The U.S. Bureau of Labor Statistics reported a loss of 85,200 jobs in the architectural and engineering sector.

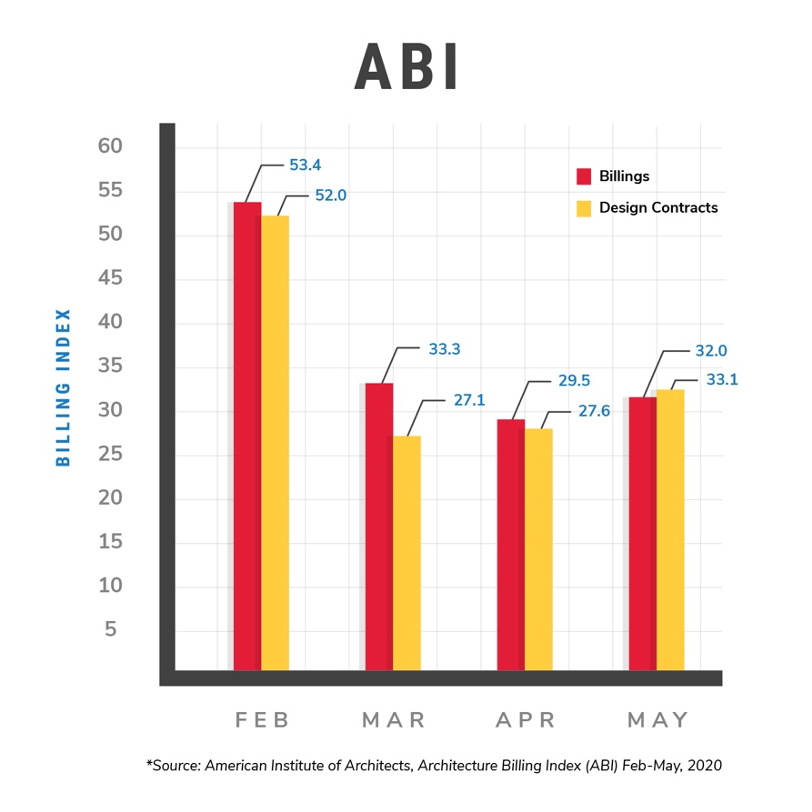

The American Institute of Architects (AIA) reported that both billings and project volume have slowly rebounded after a steep decline in volume this past spring.

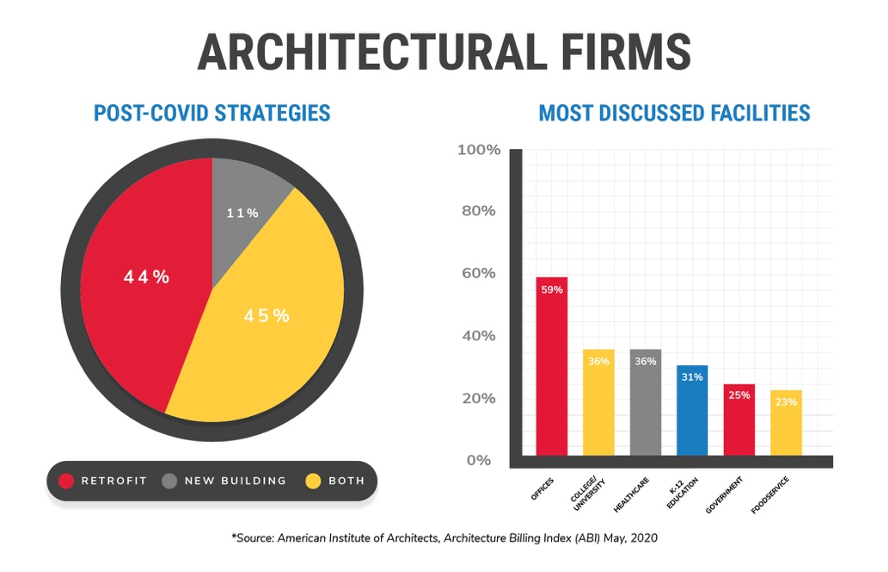

According to the May ABI report, architects are having discussions with their clients regarding post-COVID design approaches or strategies to accommodate changes in a facility’s needs:

- Almost half of the discussions (44 percent) are about a retrofit to an existing building;

- 11 percent are focused on designing a new building.

- 45 percent of architects say they are having conversations about both.

Contractors/Subcontractors: Quick Recovery, New Horizons

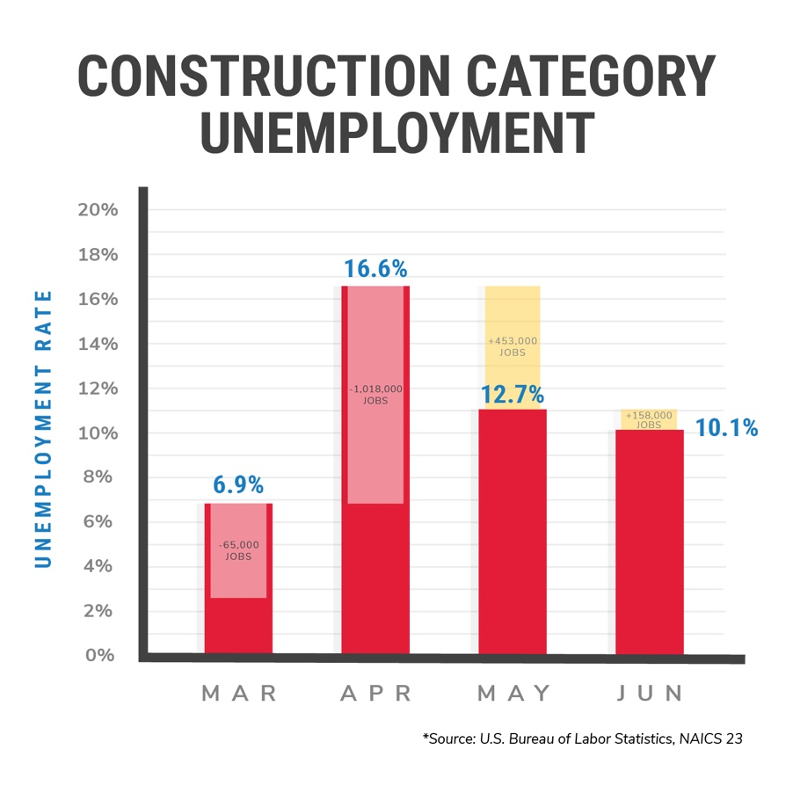

According to the U.S. Bureau of Labor Statistics, April was a devastating month for workers in the construction industry, with more than a million workers losing their jobs.

Fortunately, the statistics suggest we may have witnessed the worst of it already. Employment bounced back rather quickly in May with almost half of those laid off returning to their jobs. Of those numbers, specialty trade contractors accounted for the bulk of those gains (+325,000), with almost an equal ratio between commercial and residential construction. June continued the positive trend toward recovery. .

A skilled labor shortage still exists, and this segment of the category is expected to recover quickly. This is especially the case since COVID-19 unemployment relief expires at the end of July, motivating more workers to return. .

Demand on the residential side will be driven by many homeowners seeing the potential for a more permanent work-from-home arrangement. They’ll look to invest in their homes to make them more conducive to this changing circumstance – for themselves, and for their children, who could be required to continue remote learning. .

On the commercial side of the equation, there are plenty of opportunities emerging for retrofits to accommodate a facility for a post-COVID environment. .

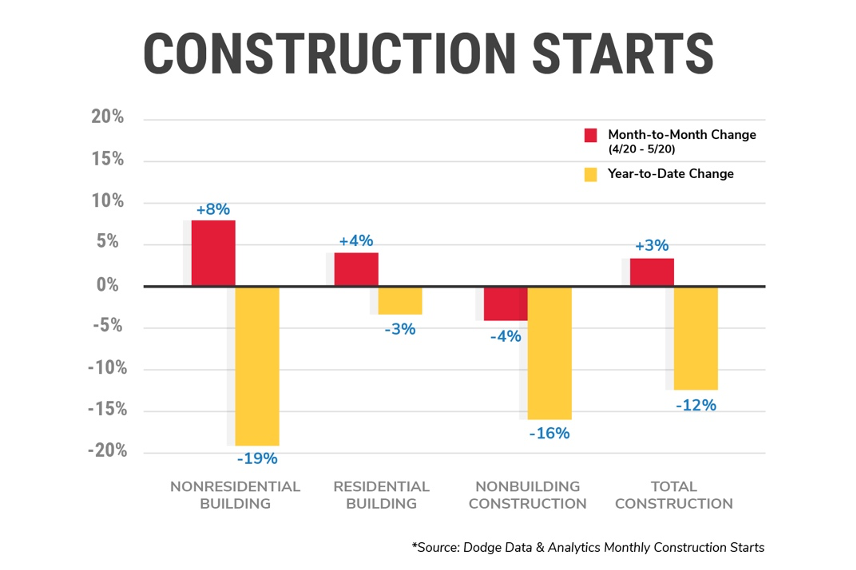

Construction starts, another key indicator, showed signs of a rebound in May with an overall three-percent increase from the previous month. Nonresidential building demonstrated a stronger recovery at eight percent according to Dodge Data & Analytics. Year-to-date numbers remain considerably lower, impacted heavily from a dismal April. .

Given the volatility in the construction labor market, look for general contractors to narrow their consideration set when it comes to subcontractors. With smaller labor suppliers facing bankruptcy or severely reduced staffs, general contractors will focus on proven, reliable resources who are primed to weather the economic storm and still be in business when they are needed. .

Building Owners: Opportunities in the New Normal

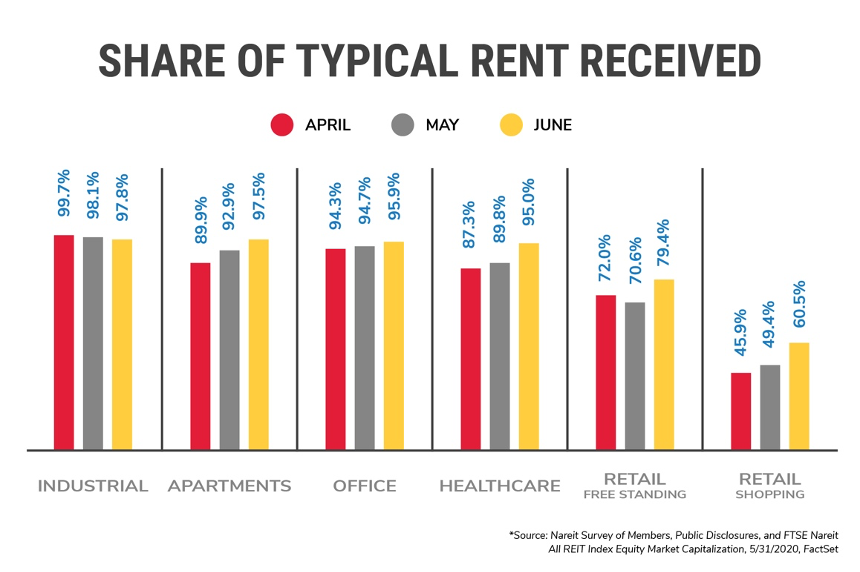

For building owners and occupants, rental receipts provide a good indicator of overall market performance and recovery. Nareit used its membership to survey rental health among a number of building rental segments. .

Rent health continued to rebound across sectors in June. Retail, while slightly improving, still faces challenges, and industrial rent has seen a slight decline. .

With the return of tenants and employees to the workplace, building owners will need to dramatically change their thinking about the space they manage. The new normal requires employers of all kinds to adapt so they can ensure their buildings are ready for the post-COVID experience. .

Consider:

- Ventilation systems must be working optimally to increase air circulation.

- New screening and social distancing procedures such as daily temperature checks and fewer people on an elevator mean people may be delayed in getting to the office.

- Social distancing requirements will also likely result in reconfigured workspaces that might include the introduction of safety glass and other physical barriers to encourage proper separation.

These emerging mandates are driving new product ideas. Buildings.com recently chronicled some of them:

- Thermal cameras to monitor and flag high body temperatures

- Physical distancing solutions that include everything from clear, acrylic space partitions to Velcro tape to block off every other seat

- Video analytics to monitor mask compliance and occupancy control

- No-touch handles with either high-tech electronics or simple traditional designs that open with a person’s wrist, forearm, or foot

In essence, the evolution of the workplace in the face of an emerging global pandemic will continue to drive product innovations, which may represent new opportunities for manufacturers of all kinds.

Let’s talk.

Have a specific marketing challenge? Looking for a new agency?

We’d love to hear from you.