August 4, 2020

Commercial & Institutional Construction – Emerging Opportunities with the COVID Recovery

PART TWO: Commercial and Institutional Construction Segments

This is the second in a series of articles from BLD Marketing that takes a closer look at how key players in the building and construction industry are weathering the global pandemic and how COVID-19 may fundamentally change the design and construction of buildings of all kinds.

COVID-19’s ripple effects on the building materials category are expected to be significant, impacting the construction market for months and potentially years to come. Part One of “COVID-19 and the Building/Construction Industry: Risk, Uncertainty and Opportunity” viewed the pandemic’s impact from the perspective of the building category’s decision makers and influencers. Part Two delves into the various segments of the commercial and institutional building materials category, identifying opportunities, threats and expectations moving forward.

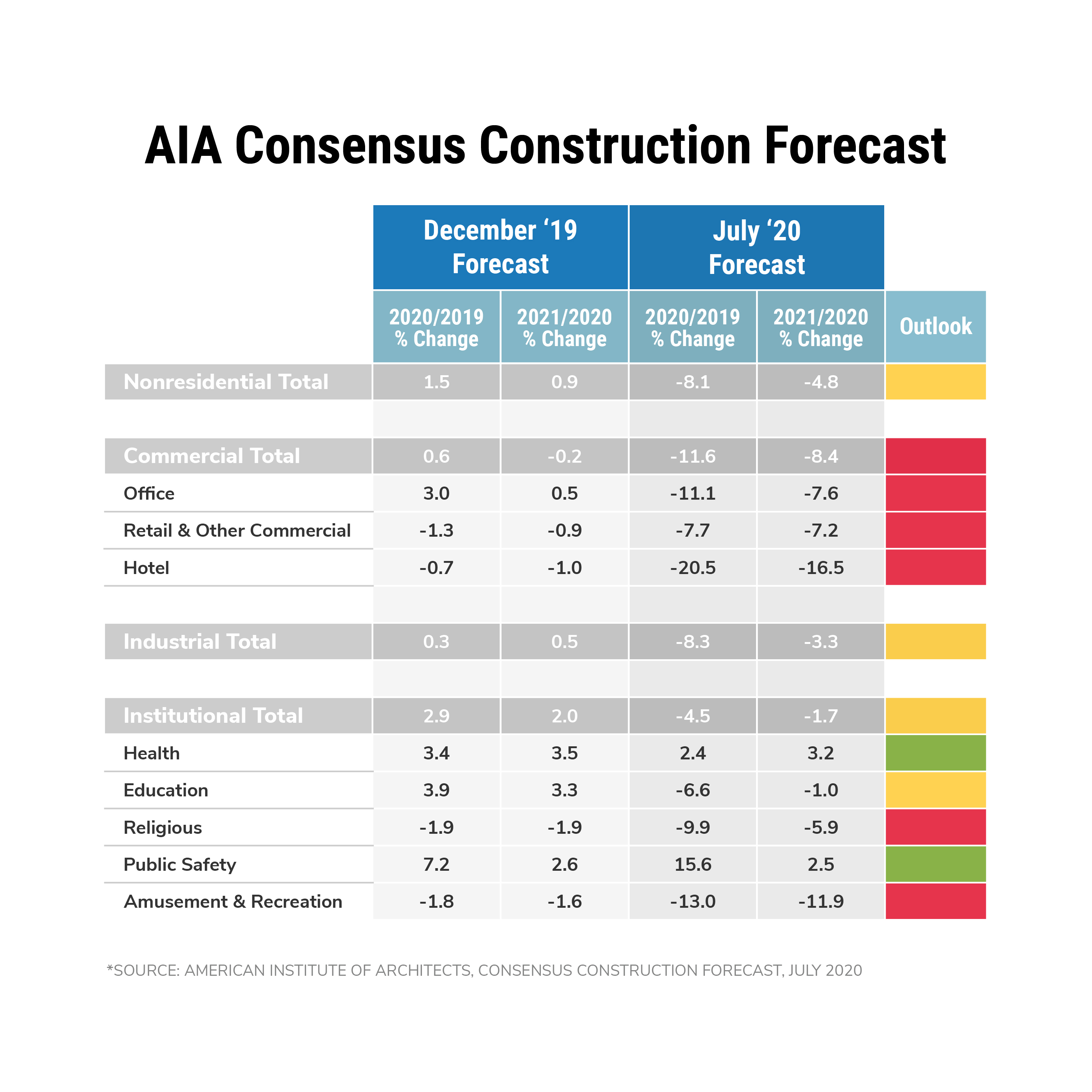

The American Institute of Architects (AIA) provides an annual Consensus Construction Forecast that aggregates projections from a variety of leading sources. The most recent forecast for 2020 to 2021 was published in July. The previous forecast was published in December 2019, which means it could not take COVID-19 into consideration. The change is staggering.

Pre-COVID, the AIA anticipated positive construction growth for healthcare, education and governmental/public safety. Retail, hotels, religious facilities, and amusement and recreation were not given strong outlooks but showed some potential. The most recent forecast tells a more challenging story for the next eighteen months. While the news isn’t great, there are opportunities presented by the pandemic.

Healthcare

Opportunity:

Construction in the healthcare segment is showing resilience through the pandemic and into 2021. Healthcare-related manufacturing will see a rise in facility development. An increase in testing protocols may create the need for additional onsite development at area hospitals. Geographic hotspots will encourage hospitals with capacity issues to expand facilities for expected patient increases. Specific improvements to airflow quality and filtering present immediate opportunities. Overall, a high level of government stimulus dollars went to the healthcare segment to combat COVID-19.

Threat:

The shutdowns led to severe under-utilization of hospitals this past spring for all other patient services. This left many hospitals working on razor-thin margins and ultimately losing significant revenue.

Government & Public Safety

Opportunity:

Public safety is projected to show an immediate boon in 2020. Government is a huge employer. Retrofit projects to enhance social distancing as government employees return to the office will account for a large volume of projects. Smaller suburban governments should benefit from increased public safely spending as COVID-19 and other factors lead to migration paths from urban to suburban living. This can increase the tax base for future infrastructure investment.

Threat:

Urban metros are hurting. COVID-19 has depressed tax and other revenue collection with shutdowns and the sudden, large-scale unemployment dynamic. Increased unrest and calls for police defunding create uncertainty in identifying available infrastructure budgets in the nearer term.

Data Centers & Warehousing

Opportunity:

This segment was strong prior to any pandemic concerns. Increased volumes of data consumption and related security concerns have resulted in consistent growth in data center development. As more folks quarantine and continue to work from home, home delivery has increased dramatically. Warehousing and logistics to handle this increased volume should lead to continued construction growth in this category.

Threat:

There are no immediate building and construction threats.

Education

Opportunity:

Schools need to retrofit facilities to accommodate social distancing. The primary opportunity lies with K-12 public schools where local governments can support funding with continued tax-based revenue. Another opportunity is with private schools. Both public school districts and colleges and universities are facing pressure from the public and teacher/faculty unions to delay the physical return of students. This will present an opportunity for private schools, who should see an influx in enrollment, and along with it, a growing financial flexibility to spend on infastructure.

Threat:

Colleges and universities have lost significant revenue since they’ve had to rely on online learning vs. the much more profitable on-campus, in-person classes. Those with healthy endowments will need to tap into them. Many others will be challenged to survive, let alone invest in infrastructure. Inner-city public schools that were already facing budget pressure now face additional strains as the tax base shrinks.

Restaurants

Opportunity:

For the few restaurants experiencing close to any volume comparable to pre-pandemic levels, investment in opening space up to adhere to social distancing is the opportunity for activity. Outdoor spaces in particular provide an increased capacity solution that offers a longer lifetime value post-COVID. Fast food and quick-serve formats are less impacted and may see expansion growth in attractive geographies.

Threat:

Probably more than any other segment, restaurants have been hit the hardest. Continued regional spikes in the pandemic make re-openings temperamental since the guidelines change frequently. With capacity restrictions limited in many geographies to 25 percent, it is difficult to rehire employees and realize profitability let alone make any physical improvements.

Commercial Office Space

Opportunity:

Given the sheer volume of office workers impacted by COVID-19, retrofitting offices for safety and social distancing will be the bulk of any construction activity in this segment. Interior improvements include everything from handle-less doors and partitions to enhanced HVAC for improved airflow and quality. The pandemic has businesses considering moves from cities to suburban locales where access to buildings is easier and safer and lower-cost space is available. Additional opportunities lie in businesses relocating to more affordable markets.

Threat:

New construction has been hit hard. While the immediate needs for COVID-19-compliant retrofits will create a short-term boost, new construction will be challenging. The work-from-home dynamic passed a huge test in 2020 as employees demonstrated it was viable. Technology has been there for a while to make the remote environment effective. Now, management attitudes are changing to realize a stronger employee trust, combined with the practical realization that lesser space is better for the bottom line. Therefore, existing office space capacity is growing. High-cost, big cities are the most threatened by this value shift as urban work environments are suddenly out of vogue. The big question is: Will it last?

Sports & Entertainment

Opportunity:

As the pandemic evens out, the construction of small venues in suburban and exurb areas may accelerate, especially where COVID-19 incidents remain low and state restrictions are limited. Outdoor settings in particular present an opportunity. Even as things return to something closer to normal, the public may be less confident to mingle in large crowds.

Threat:

Total shutdowns of sporting events, concerts, and other amusement venues have provided little or no revenue for this segment for most of 2020. Layoffs are abundant, and the return of professional sports has come without live audiences. Cost pressures are enormous to maintain facilities where activity is just returning in its limited form.

Colleges may cancel sports for the upcoming fall, and many high schools already have. Many amusement parks have reopened but with limited capacities and strong COVID-compliant safety measures. Budgets cannot support facility investment in the near term, and the AIA Consensus Construction Forecast gives this category one of the most negative outlooks. In fact, the anticipated downward trend in this sector is second only to hotels and resorts.

Resorts & Hotels

Opportunity:

The next eighteen months expect to be very challenging for this segment. However, there are opportunities for necessary improvement to accommodate a COVID-ready environment. HVAC is a key area, as air quality is critical in a hotel setting.

Threat:

The AIA Consensus Construction Forecast identifies this segment as the weakest heading into 2021. Business travel has barely resumed, and the vacation season has been depressed. Many convention centers have cancelled events that drive hotel occupancy, and there’s limited hope for tradeshows and destination events to return anytime soon. Even when events do resume, a lasting fear of crowds and staying in public places will reduce the amount of in-person event activity. Plus, technology has opened the door for more virtual meetings and events. With profitability so challenged and debt payments stacking up, the hotel and resort segment has limited capability to invest in new construction.

Religious Buildings

Opportunity:

Onsite religious activities have been greatly affected by the Coronavirus. Many facilities had to shut down during the height of infections, and some continue to limit physical interactions as spikes occur in geographic hot spots. At the same time, the emotional connection that members maintain with their religion may create an opportunity for donor investment to spur construction and buck the trend.

Another opportunity is with private schooling. Decisions by many public schools to remain shut down in the fall have parents looking to religious-based private schools as an option to ensure their child is getting a full day of education in the classroom rather than at home. This will impact the segment more in 2021 as enrollment growth is more stable to support infrastructure investment.

Look for opportunities to focus on immediate COVID-related improvements – creating larger space environments for crowds to safely attend services, HVAC improvements to air quality, and the development of outdoor spaces that are safer and can handle larger crowds.

Threat:

Churches of all types have faced declining attendance even before COVID-19, and the pandemic has severely limited any attendance for most of 2020. Churches depend on regular in-person attendance to keep donation revenue strong.

Industrial

Opportunity:

Forecast shows a troublesome 2020 but an improved outlook into 2021. Given the pandemic, there’s a sentiment to bring back domestic manufacturing for essential items. Look for pockets of opportunity with new facilities for medical care equipment, hand sanitizing, and high-tech telecom and electronics. There’s a push for inventory preparedness and data security driving these manufacturing decisions back to the U.S. In addition, trends continue to keep marijuana growing facilities in demand.

Threat:

Finding growth in manufacturing for the U.S. is tough during prosperous times, let alone now. It is still difficult for domestic manufacturing to compete with products manufactured abroad.

Retail

Opportunity:

Suburban, free-standing retail and strip malls are somewhat positive, especially when anchored next to grocery, big-box home improvement and other destination-driving stores. As suburban migration continues with more remote working and homeowner cocooning, home improvement brands and paint stores are seeing momentum.

Threat:

The continued pressure on online shopping has already squeezed traditional retail. COVID-19 is another nail in the coffin for many independent retailers and chains now facing bankruptcy or simply not planning to reopen. Urban-based retail is at considerable risk, missing the mid-day office worker crowds. The retail segment is more delayed in making rent payments than any other industry.

A Fluid Situation

The onset of the global pandemic this spring and its widespread effects on every facet of America life – from the workplace, to education, to leisure, travel and business – has quickly taught us that we indeed live in uncertain times. The market forecasting is volatile. What begins to build momentum one month may not sustain itself over time. Building materials manufacturers that properly identify and prioritize opportunities over the next 18 months – opportunities that closely align with both their brand and expertise – are more likely to get their fair share of the market.

Let’s talk.

Have a specific marketing challenge? Looking for a new agency?

We’d love to hear from you.